April 18th 2022

I think pretty well everyone close to the market these days would agree that things are changing. It’s not so much a reaction to the numbers. They haven’t changed all that much. It’s more of a feeling. Things are slowing somewhat from the hectic pace we’ve seen pretty much throughout the COVID era.

Of course there are a lot of factors at play. The Ontario government has just modified the foreign buyers spec tax. It has as of April 1, 2022 been increased from 15% to 20%. At the

Of course there are a lot of factors at play. The Ontario government has just modified the foreign buyers spec tax. It has as of April 1, 2022 been increased from 15% to 20%. At the

same time it has expanded to include not just properties in the Golden Horseshoe but now the entire province. Interest rates are on the rise. To begin only modest increments but we are told we can expect multiple increases in 2022 and more in the order of .50% at a time, as opposed to the original increments of .25%. And of course COVID. While we are enjoying a relaxation of restrictions at last, there is still a worry about another wave and another variant. Nobody really knows where that is going.

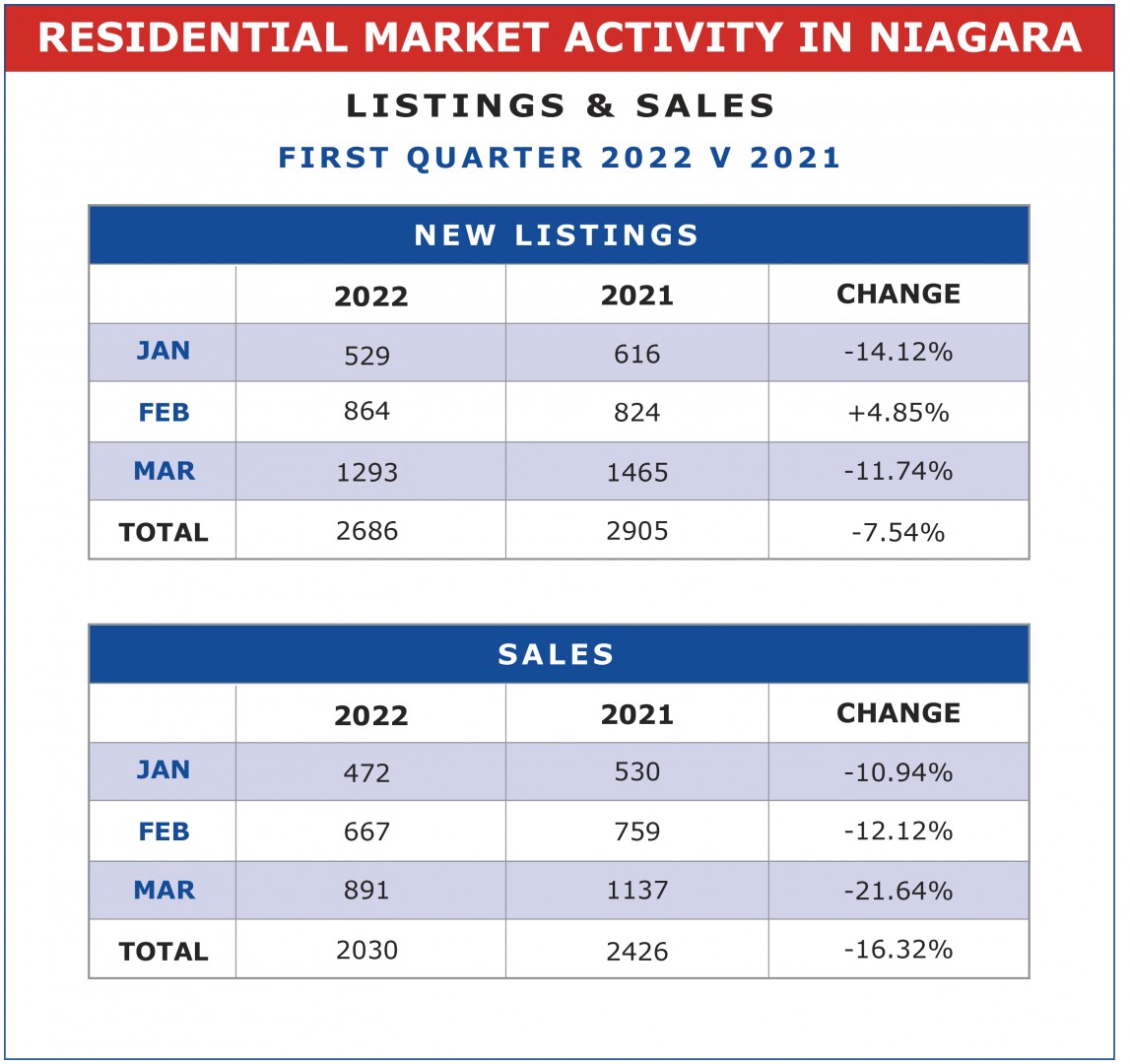

So what we are seeing is a slight decline in activity. Unit sales, while increasing each month since the start of the year, are down from the corresponding months in 2021. And of course that is reflected in the marketplace by fewer showings on listings and fewer multiple offers coming in. Of course, there are still situations where 15-20 competing offers come in on a property, but 3 or 4 Is more the norm.

The other thing that is somewhat surprising is that listings are also down year over year. Each of the first three months this year saw an increase in new listings compared to the previous month. Not surprising as we move into the spring market. But here again, with the exception of February, each month saw fewer new listings added to inventory compared to the corresponding month in 2021.

So how does all this play out in prices properties are selling for? What is happening there? Well, across the region, the average sale price in March came in at $854,761. That’s down $7296 or 0.96% from February. Statistically insignificant. What is more significant perhaps, is the fact that while huge price gains were registered from the end of December 2021 to the end of February 2022, not much has really changed since. Average price from January to March 2022 saw an increase of $12,174 or 1.44% as compared to $23,706 or 3.61% over the same two month period in 2021.

So putting it all together what are we seeing? Well, overall a moderation in sales activity and a moderation in price gains month over month. Now don’t misunderstand. The market is strong. Sales are still at historic highs as are prices. But based on what we are seeing, we may not see the substantial 25%-35% price increases we have seen over the past couple of years. And on the heels of that we can expect to see a slight drop off in unit sales activity as some spectators drop out of the marketplace. Looking ahead we see a good steady solid year for both buyers and sellers, with two areas of caution to keep an eye on. Interest rate hikes and Government intervention.