April 17th 2023

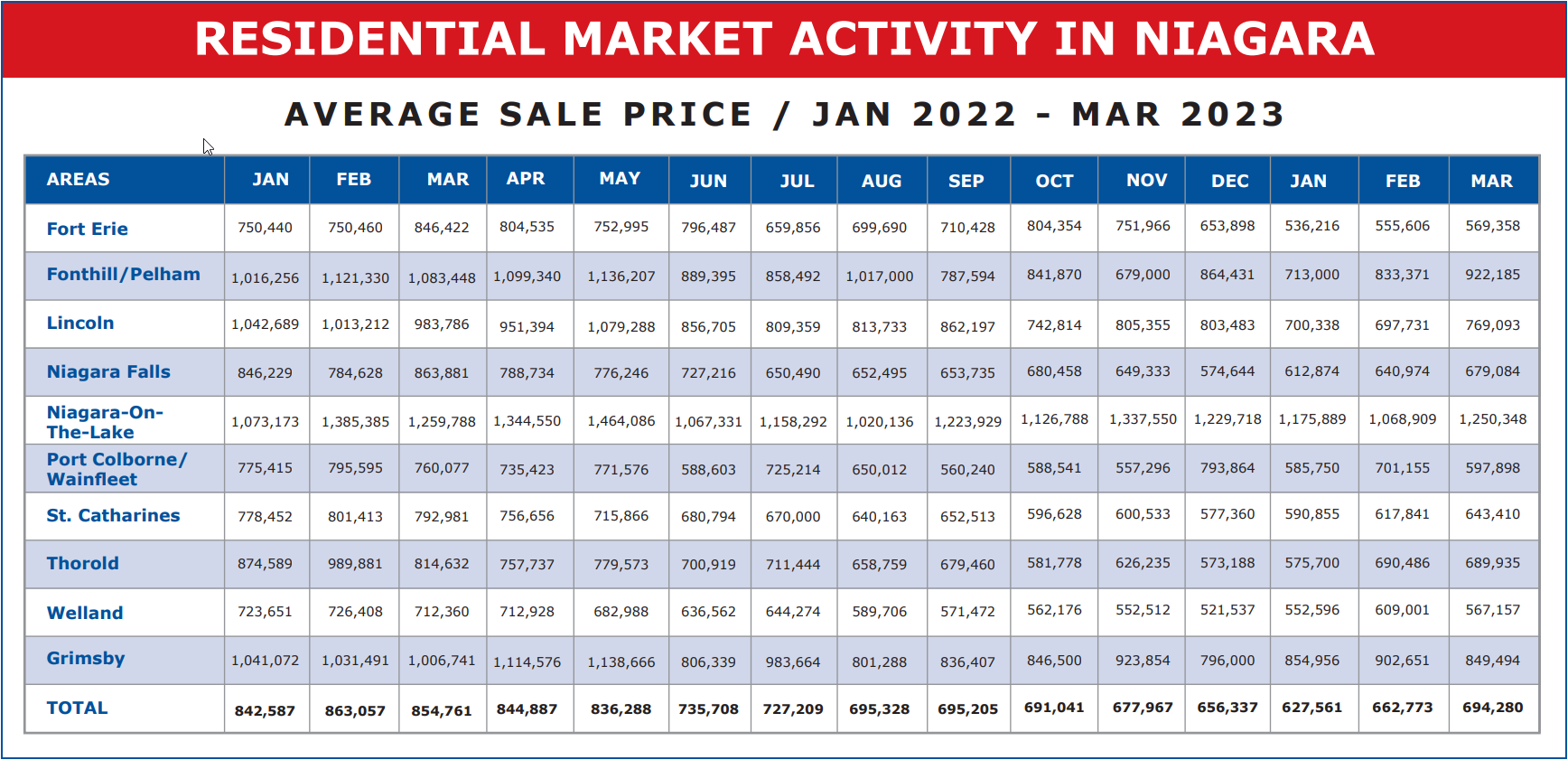

Back last August the average sale price of residential property across the region came in at $695,328. And that price held pretty steady for three months: (August - $695,328, September - $695,205, October - $691,041). After peaking at $863,057 back in February 2022, the prices slid pretty steadily for the next 6 months up until August. It seemed that prices had bottomed out and were now pretty stable. But that was not the case. Beginning in November the average price began to soften again and this continued through January, which recorded an average all the way down at $627,561, a drop of almost 10%. But now, in February and March that downward trend has reversed, and gained back all those recent losses. March average came in at $694,280, a gain of $66,719 or 10.63%.

Now you may say ‘Well that is not all that significant if we’ve just gained back the prices we’ve lost since October'. And while that may be true, what I believe is significant is that this is the first time prices have increased month over month since the peak of the market in February 2022. Every other month has lost ground from the previous month!

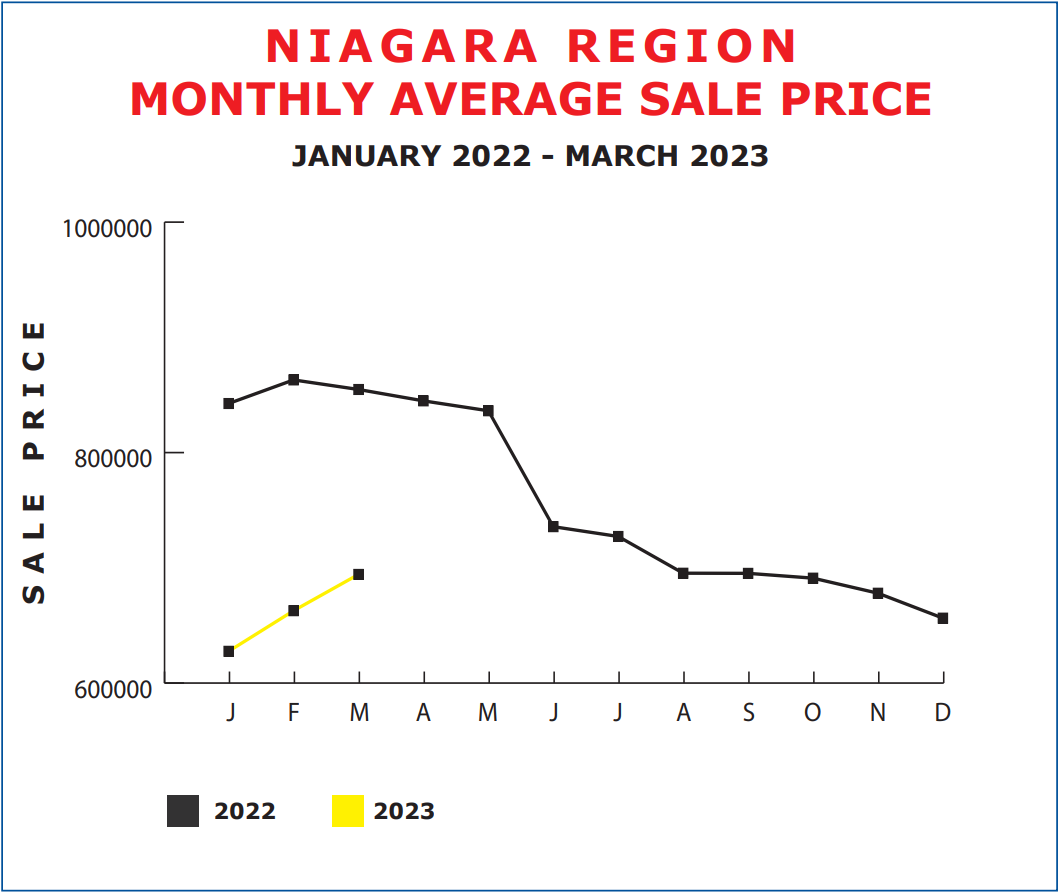

To illustrate what this looks like, I’d like to share in graph format the average price across the region as it came in month by month since January 2022. This will show the roller coaster ride of peak to valley and then what’s happened over the past couple of months.

As you can see we certainly haven’t gained back the average sale prices lost since February 2022 (we are currently down $168,777 or 19.6%) but we are heading in the right direction. Is this a trend, or is it a ‘dead cat bounce’? Time will tell. The next 2 or 3 months will be very significant, but the key ingredients to a strong recovery seem to be in place: interest rate stability (fixed-rate mortgages have dropped recently and the Bank of Canada has put a brake on interest rate hikes at least for now) and price stability better than flattening, if the past two months are any indication prices are on the rise and that, if it continues, will have a motivating effect on the whole marketplace: speculators, investors and of course end users.

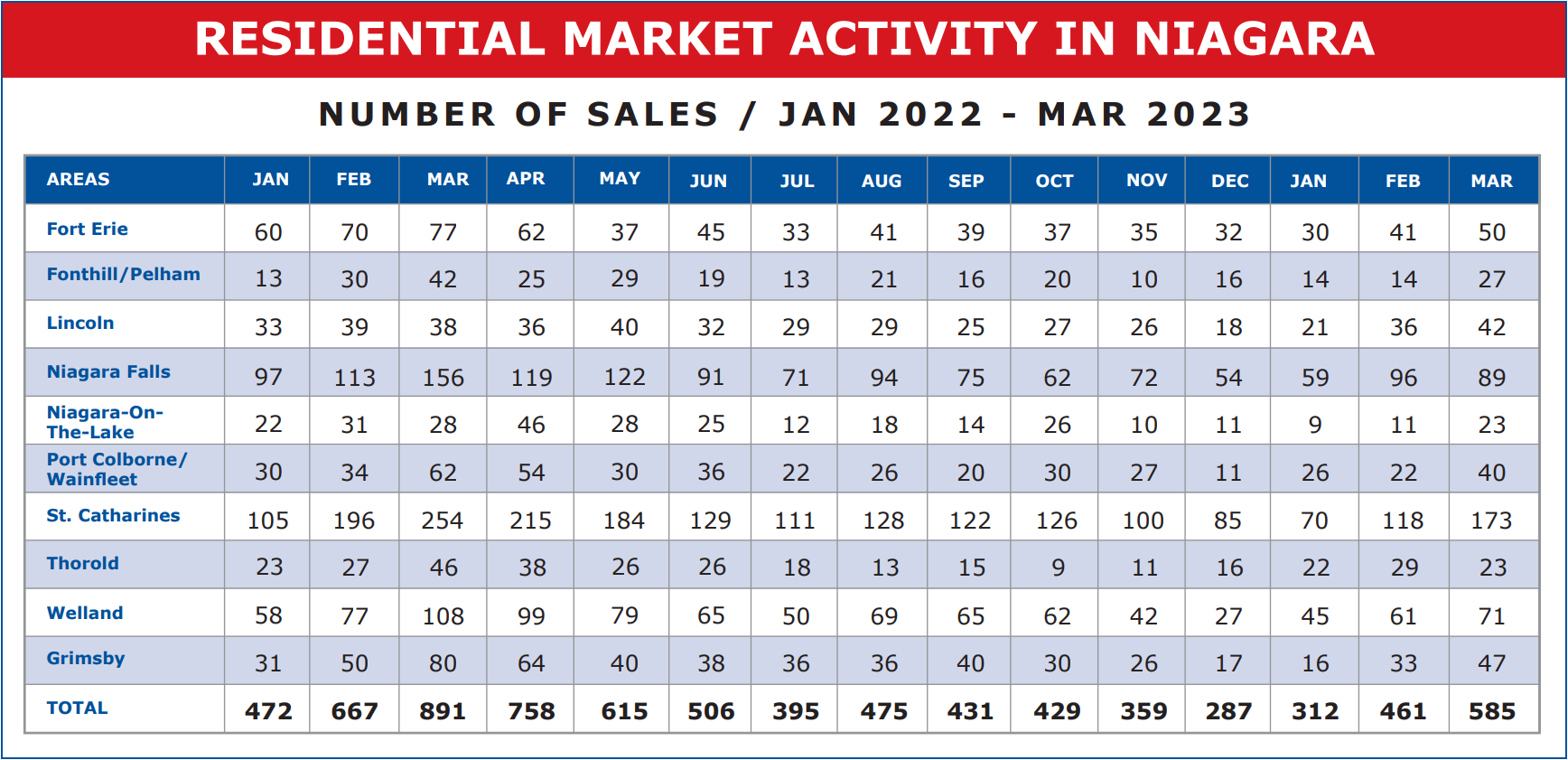

Now, what about sales activity? How are we doing in that department? Well, March registered a total of 585 units sold across the region. That’s up 124 units or 26.9% from February, but still down 306 units or 34.3% from the 891 registered last March. Still down significantly but not the 50% drop we have been experiencing. And when you consider that last March was the strongest month of the year in terms of units sold, we’re actually not too far off the mark.

That’s not to say we’re not down considerably from the 1,137 recorded in March 2021 (an all-time high) but we are headed in the right direction.

So in summary, there are a lot of reasons to be optimistic about the future of real estate. There is a general sense of optimism in the marketplace. People want to get back in the game. They want to buy, they want to invest, and yes, they want to speculate. As we’ve said, the next few months are going to be very interesting. Will the price trend hold? Will interest rates remain in the moderate territory? And will trading activity continue to increase? From this vantage point, I would say ‘yes’, but stay tuned!