August 15th 2025

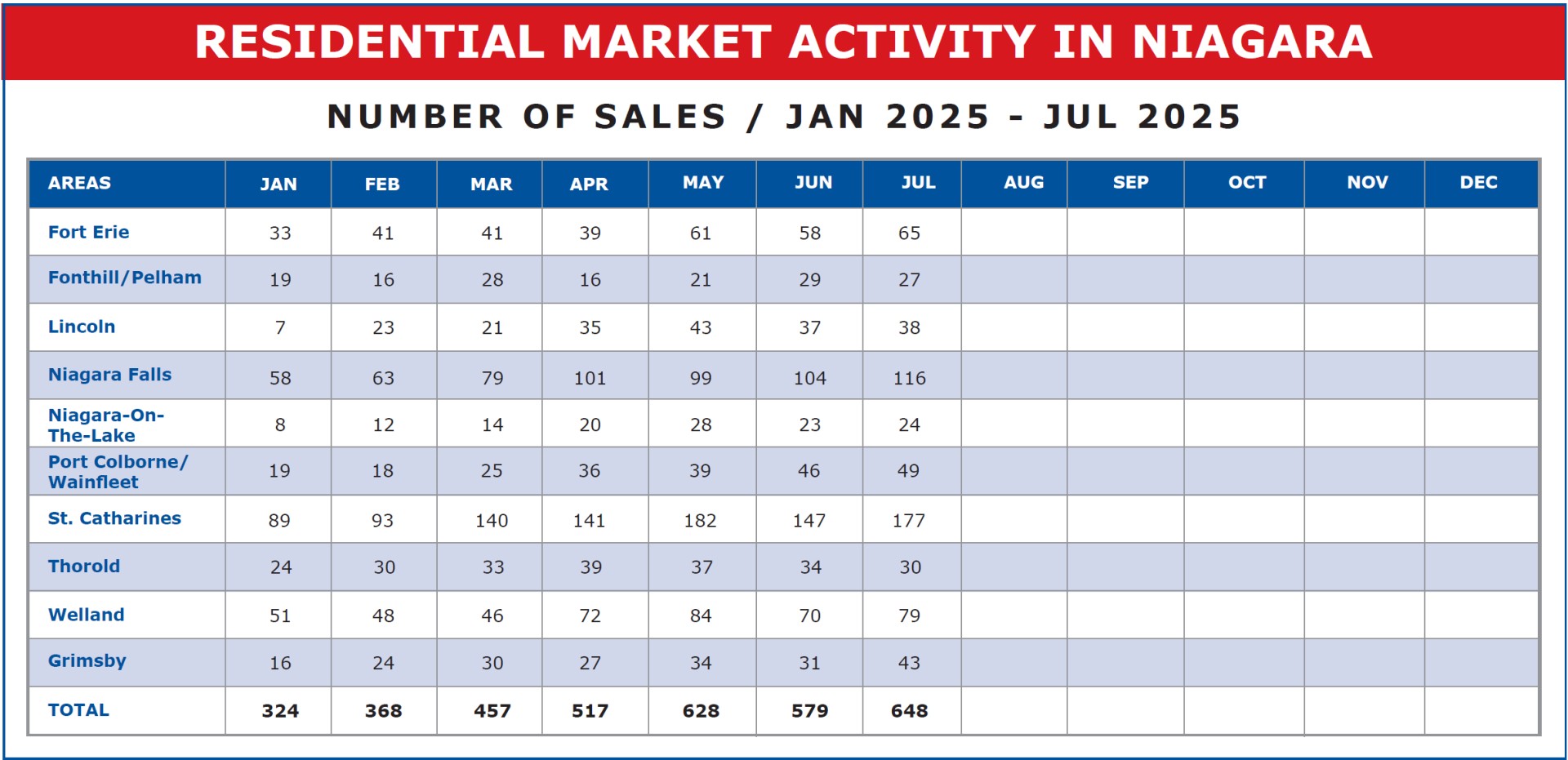

Interesting dynamics going on in the real estate market at the moment. Prices, as we expected, are falling as we move into the second half of the year. July at $663,841 is actually down $13,466 from June. A drop in one month of 2%. At the same time, unit sales, which should be falling in lock step with prices are actually on the rise. In fact, July recorded 648 sales across the region. That not only compares favourably with the 529 figure we saw in June. It is actually the strongest month so far this year. Interesting.

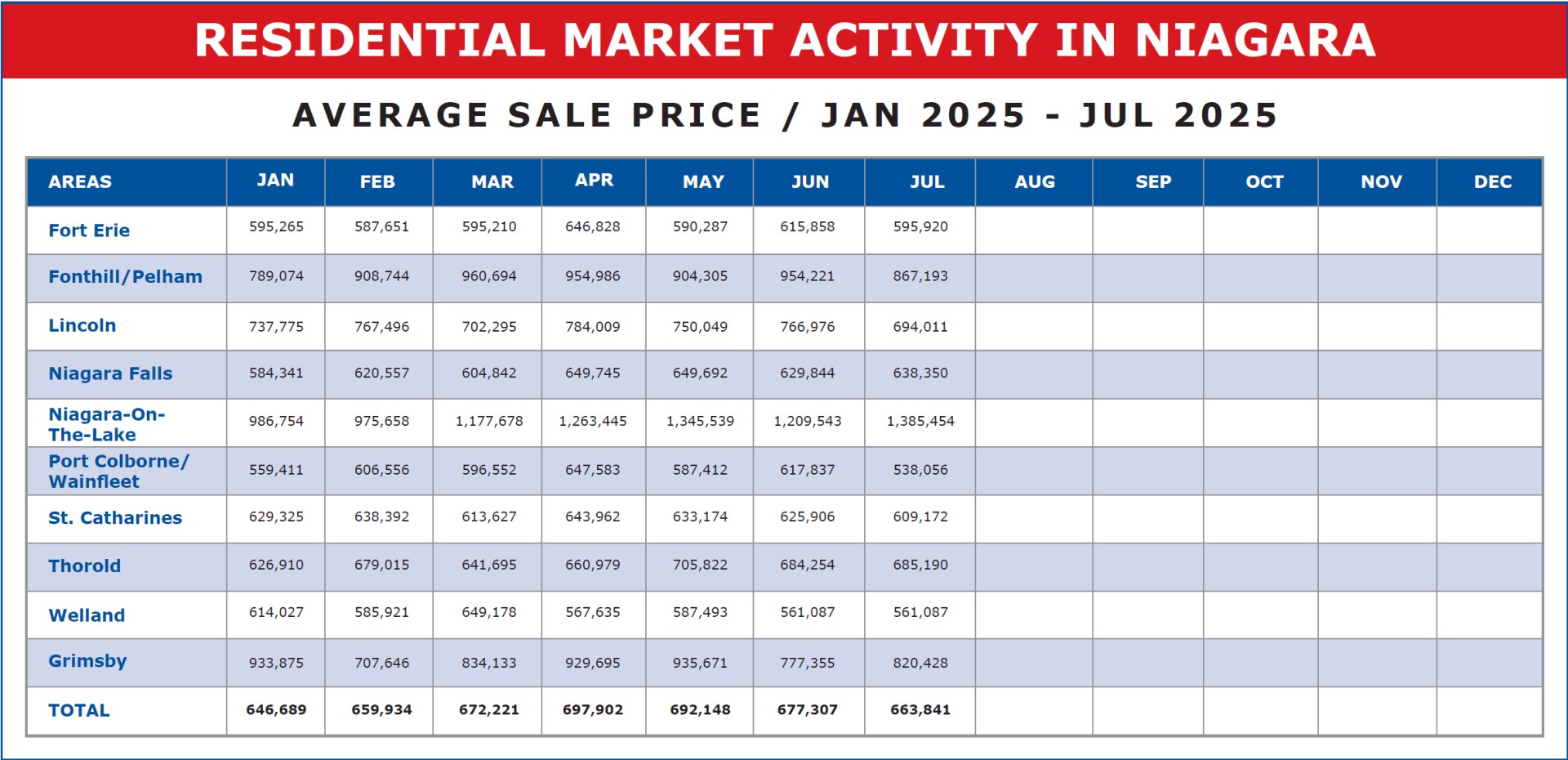

Let’s begin with a closer look at prices. As we’ve said, July’s price average for residential sales came in at $663,841. Down from June. For the past couple of years that’s a trend that we have seen repeatedly. The market gains ground in the first 6 months of the year, and then loses those gains in the last six months. What’s unusual this year is how early that price reversal occurred. Rather than cresting in June, this year the market reached its peak in April. Prices have been sliding since.

*Sales data provided by the Niagara Association of Realtors and the Hamilton-Burlington Realtors Association as submitted through Brokerage Members inputted MLS sales.

*Sales data provided by the Niagara Association of Realtors and the Hamilton-Burlington Realtors Association as submitted through Brokerage Members inputted MLS sales.

The July regional average of $663,841 is just slightly above the $659,934 figure recorded in February (up $3,907 or 0.59%) but down $34,061 or 4.9% from April’s high. A more startling contrast perhaps is the difference in property value from one year ago, July 2024 when the average sale price came in at $690,054. That’s a year over year drop of $26,213 or 3.80%.

What can we expect from here? Well, in 2023 June was the record month with average prices coming in at $736,491. By year end, those sales values had fallen to $644,067. A drop of $92,424. In comparison the price slide in 2024 was much more modest. Again, the high point was June 2024 where price crested at $744,110 and by year end had fallen to $678,274. A drop of $65,836.

This year the high point price wise came in at $697,902 in April. Two months early. Since that time prices have lost ground each month to arrive in July down $20,595 or 2.95% from the April high. A more modest slide but because the slide started early we still have 5 months to year end. No doubt there will be more lost ground, but with stronger sales numbers, I expect the average price loss to year end will be relatively modest.

So, let’s take a look at the unit sales numbers.

*Sales data provided by the Niagara Association of Realtors and the Hamilton-Burlington Realtors Association as submitted through Brokerage Members inputted MLS sales.

*Sales data provided by the Niagara Association of Realtors and the Hamilton-Burlington Realtors Association as submitted through Brokerage Members inputted MLS sales.

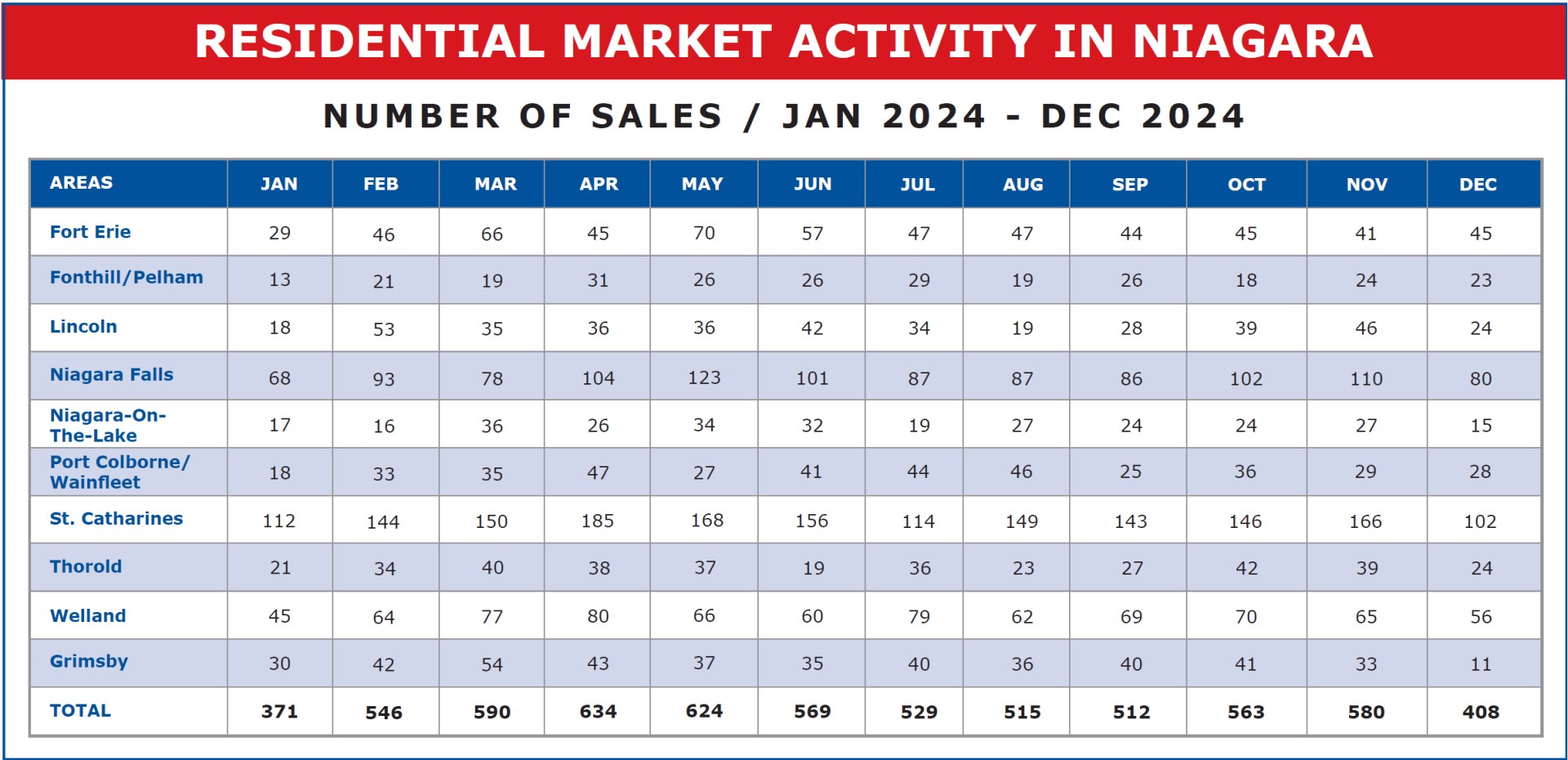

In 2024, the strongest month for unit sales was April, right where you’d expect, in the start of the spring market with 634 units sold. By July that number had shrunk slightly to 529. The interesting thing however was the fact that the sales numbers remained relatively strong throughout the second half of the year.

This year, by contrast, July came in at 648 units sold. That’s 119 units above the 529 registered last July and it’s the highest monthly volume recorded this year. So, it would appear that while prices will continue to slide over the balance of the year, unit sales may not. Contrasting forces. It will be interesting to watch the balance of the year play out, and especially the early part of next year to see if this moderating trend continues and if perhaps prices begin to register lasting gains.