December 15th 2022

The market continues to perform pretty much as expected. The November sales data is now in from the Board and although it shows a slight dip the average price for the Region, $13,074 or 1.89%, of the 10 municipalities tracked, half show price increases month over month, and half are down.

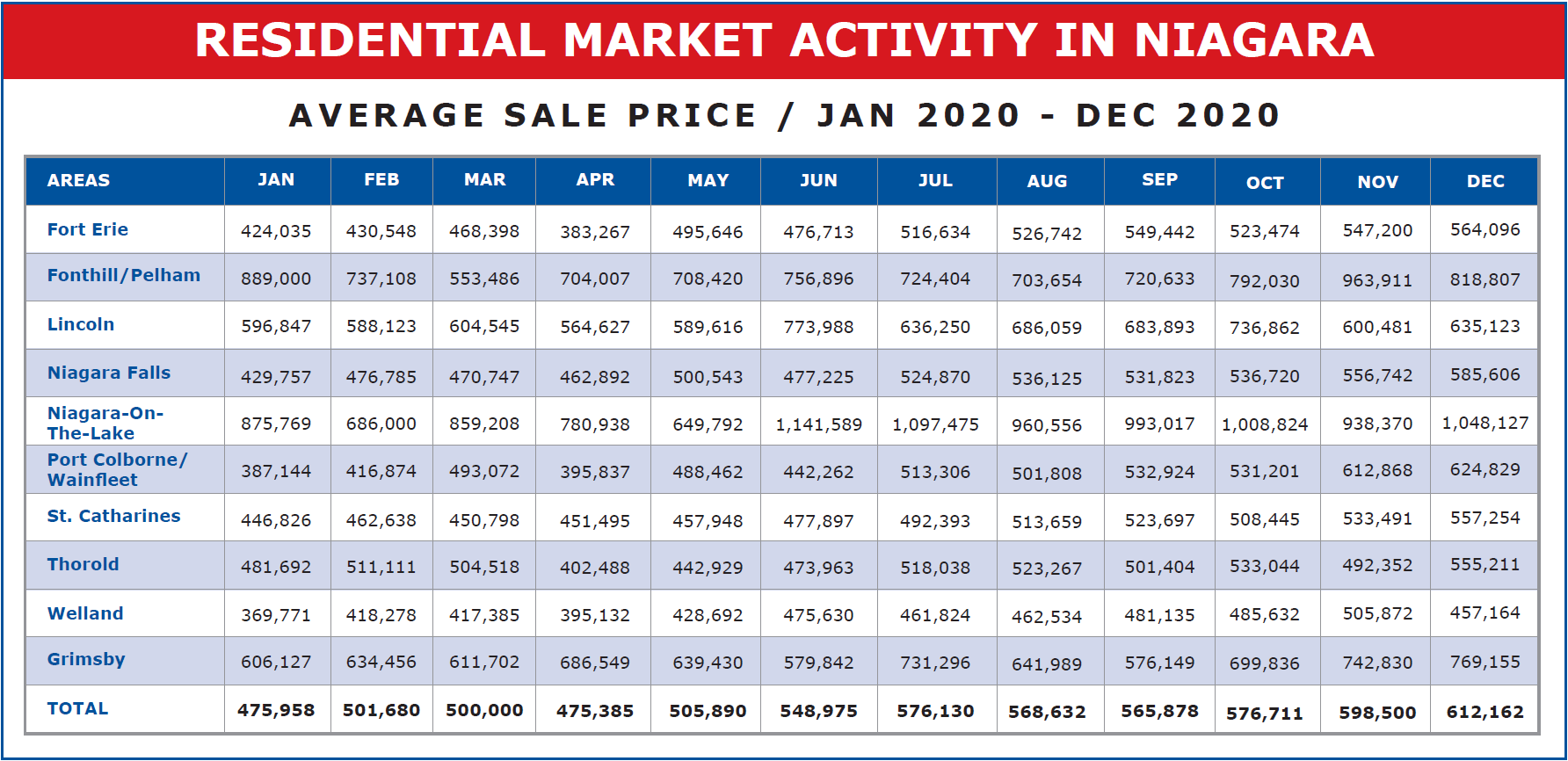

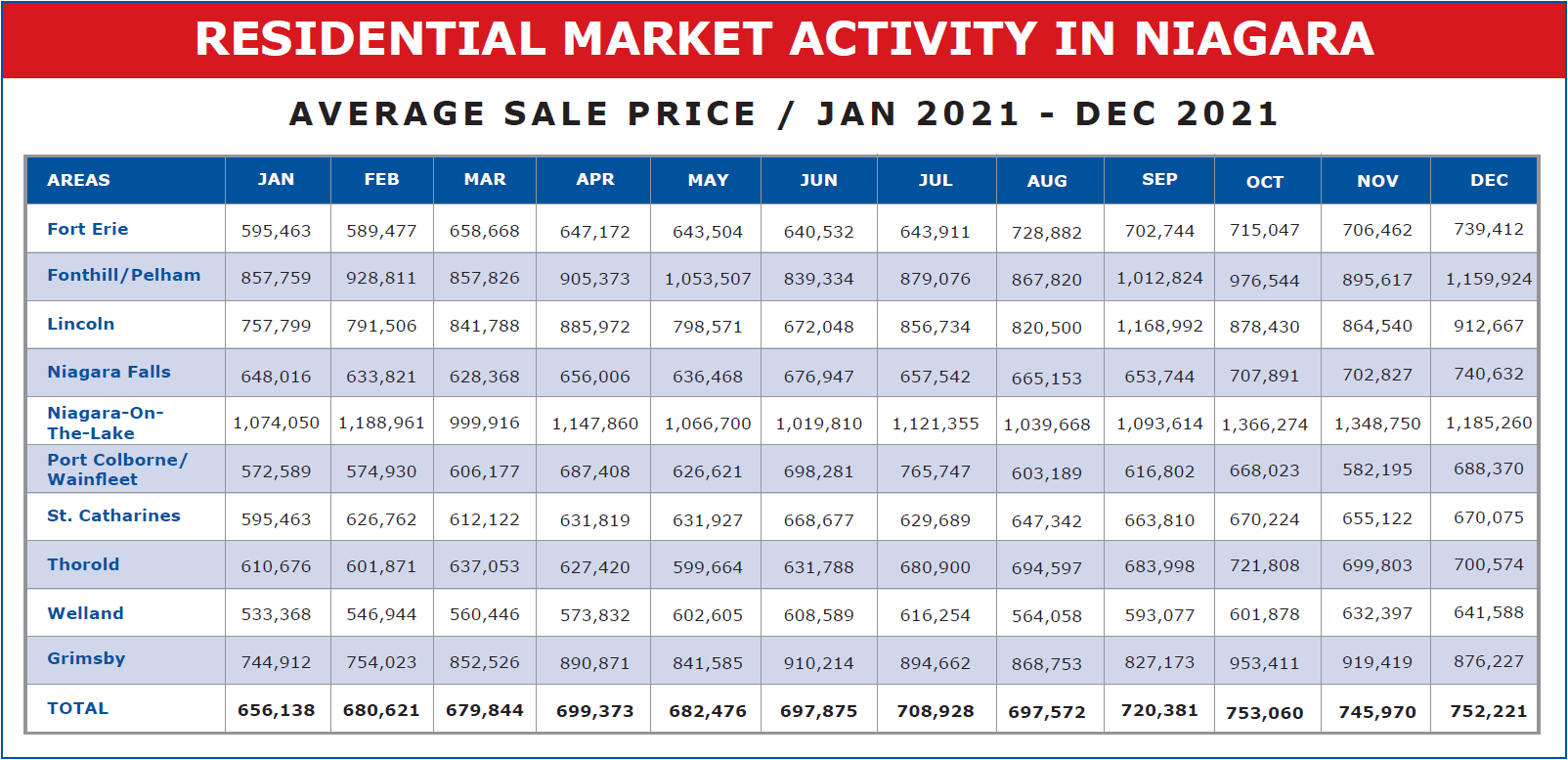

So, what we see is that the market seems to have stabilized, price wise, at about the level it was at in early 2021. The very significant gains of 2021 and early 2022 have been given back. However, it’s interesting to look at the year 2020. The onset of Covid. That’s when the prices first started to spike. When we look there, we see that the average price across the Region is up $202,009 or 42.4% since that time. And if we go back five years to November 2017, we see that the average sale price across the Region was $394,402 then. Today we are up $283,565 or 71.90% from then. And going back to November 2016, 6 years ago, when the average sale price in the Region was $347,778, we are up $330,189 or 94.9%.

So we have almost doubled over the past 6 years. I’d be very happy if that happened over every 6 year period. I think we all would, but it’s unsettling to see the market give back the monumental gains we had enjoyed of late. Keep in mind that the market was really on a tear. In January alone we saw the average price in the Region increased by nearly $100,000. Not only are those type of gains unsustainable, they are also very unstable and subject to corrections as we’ve seen.

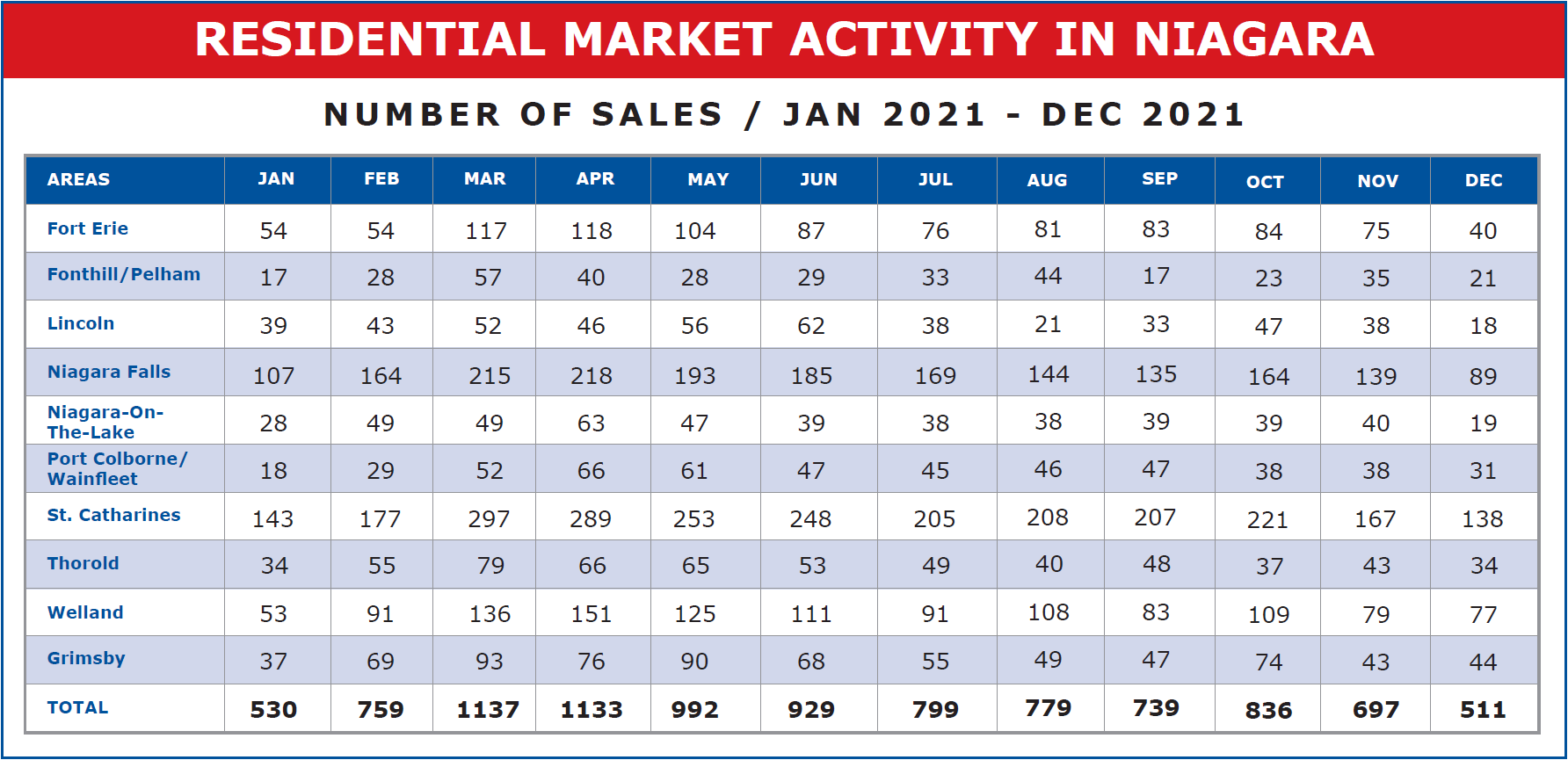

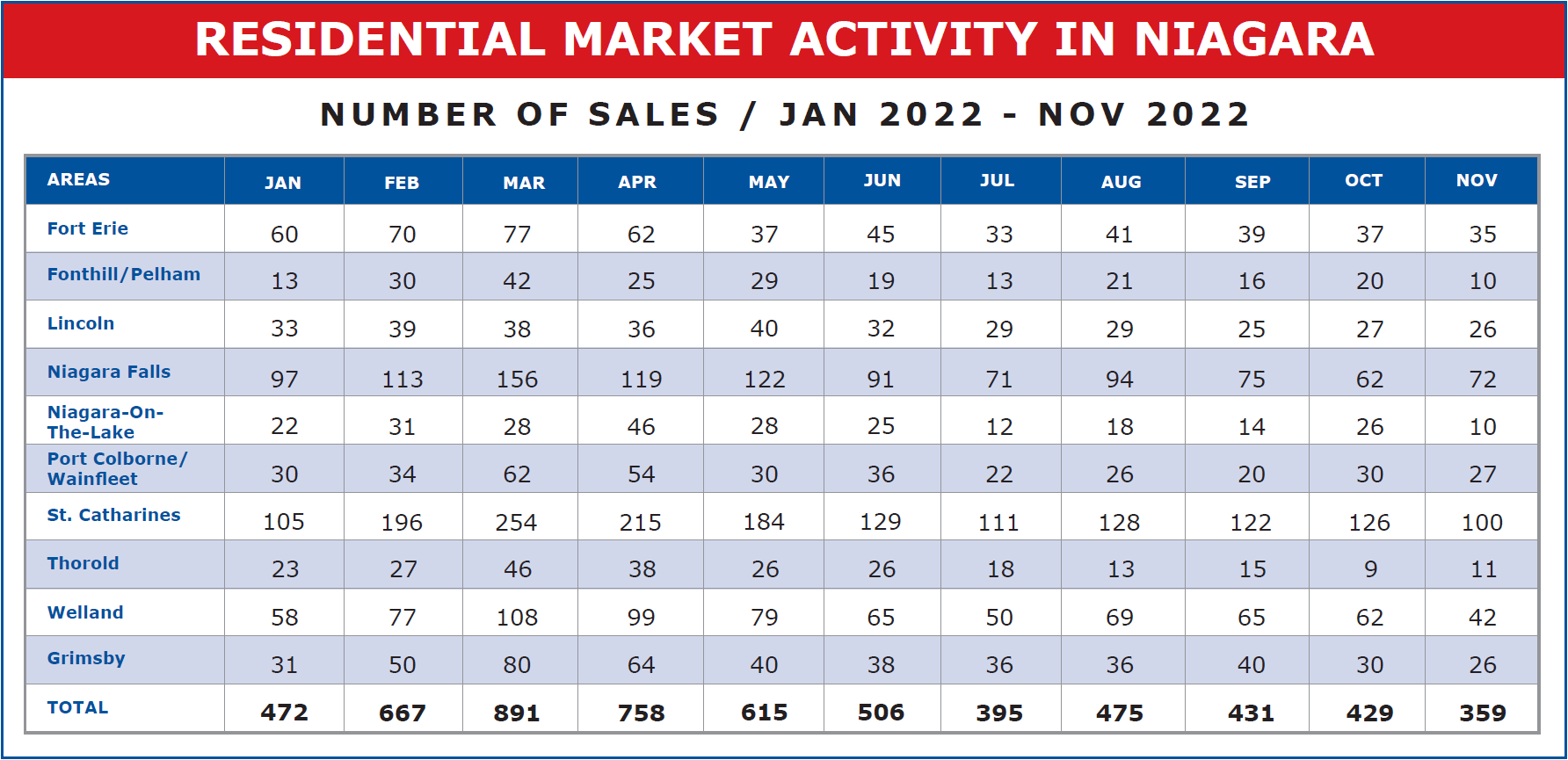

The market seems to be staying the course on unit sales as well, settling in at just over half what they were a year ago. November saw a total of 359 residential sales register across the Region. That’s down 80 units or 18.65% from October. That drop is really a reflection of the season rather than the market. Last year, in the very active market, we saw a drop of 139 units or 16.63% from October to November. And we can certainly expect to see the activity fall off again in the month of December. What’s interesting however is the comparison year over year. Last November registered a total of 697 residential units sold. This year’s 359 represents a drop of 48.49%. Again, about one half.

As we’ve seen previously, the largest factor contributing to the drop in unit sales is the fact that speculators are for the most part out of the market. However, there are a number of investors and end users who I believe are holding off and taking a ‘wait and see’ attitude. Wanting to be sure things have settled down before they wade back in. December of course will not see any kind of resurgence in sales. That’s just a seasonal reality. January and into the spring market are what we want to watch carefully.