February 15th 2023

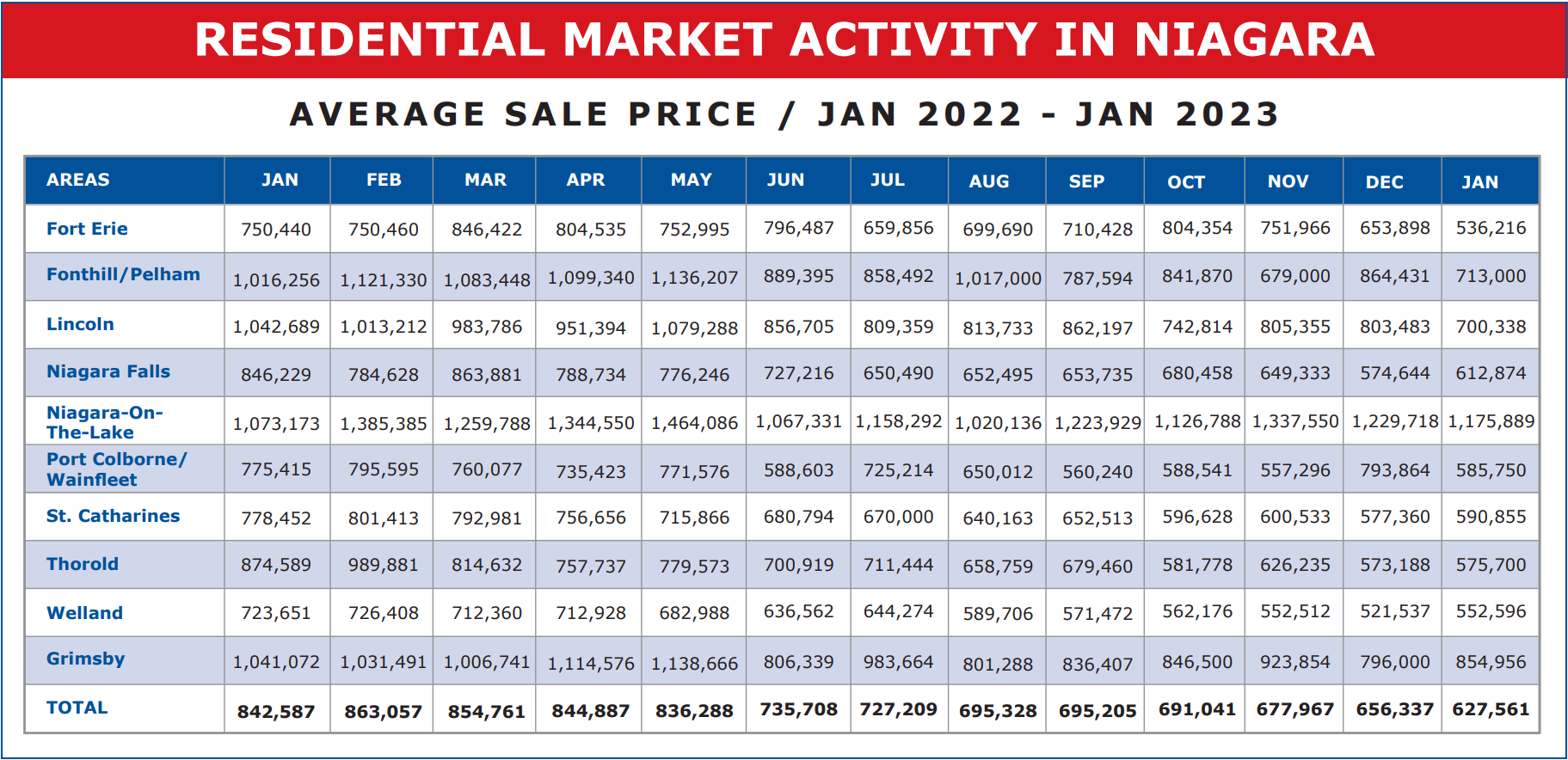

I’m optimistic about the market for 2023 and beyond. You might wonder why looking at the sales figures for January. According to the numbers, we see that the average sale price across the Region came in at $627,561, which is a drop of $28,776 from December or 4.38%. That’s sizeable.

So why in the world am I optimistic? Well to get a better understanding of what is going on we need to look at the HPI (Home Price Index) for the same period of time. HPI as you may recall is the average price of 50+ year old 3 bedroom brick bungalows with two baths and single attached garages. Apples to apples. When we look at these figures we see regionally the average price came in at -$2,500 or a drop of 0.4%. Statistically insignificant.

So, two questions should come to mind. First if HPI is more statistically accurate since we are comparing similar properties, why am I not using them? And secondly, why such a difference between the two systems anyway?

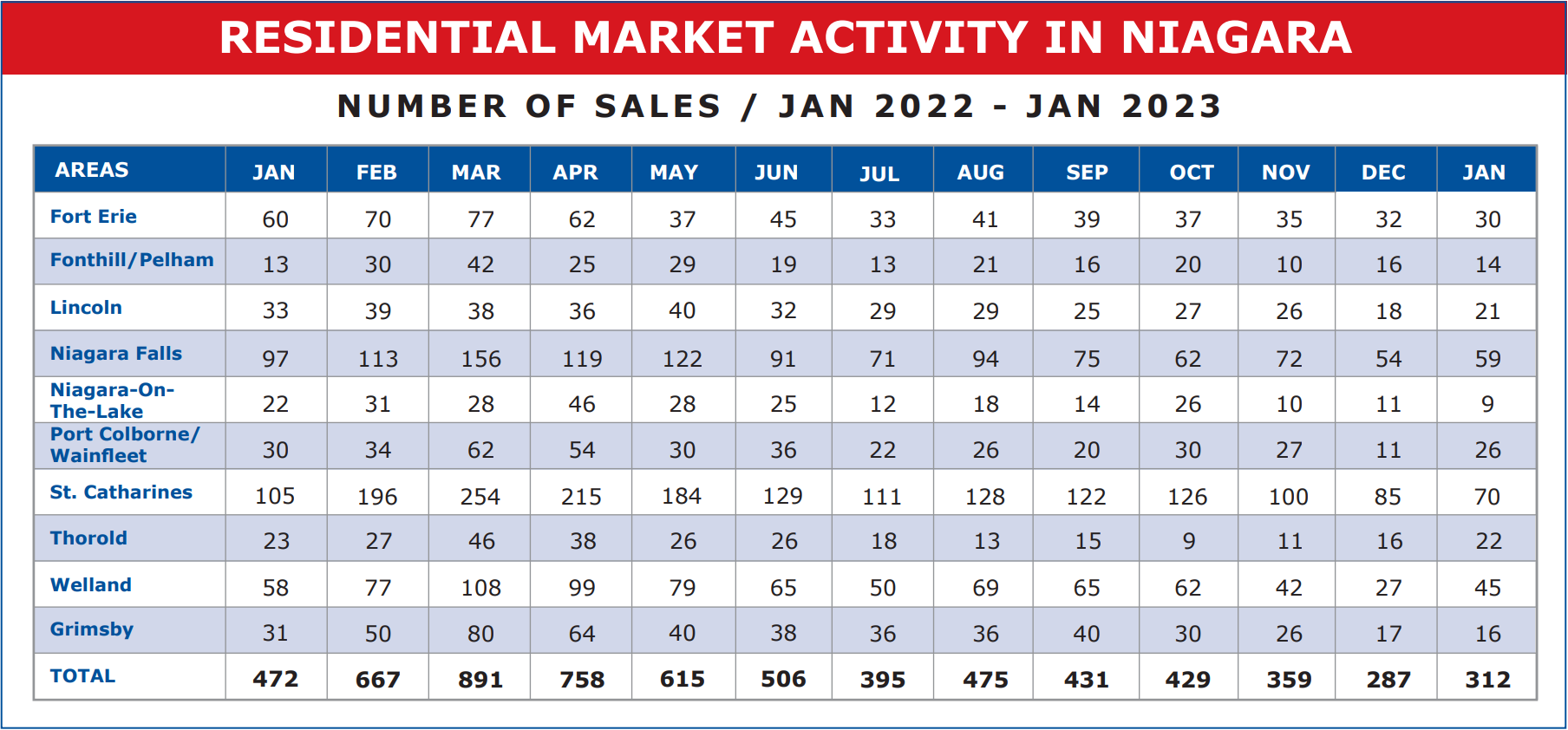

Well, when I analyze sales figures, I often go back several years. And HPI is a relatively new system. For me to switch over would mean that I could only accurately go back 2 or 3 years for comparison trends, otherwise I would be comparing two dissimilar numbering systems. And secondly, when you consider the very limited property criteria being used in HPI, one has to wonder where the comparables came from in markets like Niagara-on-the-Lake, which recorded only 9 sales in January or Fonthill/Pelham, which registered 14 sales. It’s doubtful either of these markets registered even 1 50+ year old brick bungalow with 2 baths, let alone 2 or 3 for averaging purposes.

But on to the next question – What is going on to cause such a significant difference in results between the two systems? Answer – rising interest rates.

Let’s suppose a buyer is qualified for monthly payments of $3,500. It stands to reason that with interest rates pushing 5%, he is going to be looking at a much lower purchase price than when interest rates were around 2%. So, it’s not that prices have slid, it’s that buyers are buying less prestigious property types as well as sizes and condition. And that leads to one of the reasons for my optimism. Interest rates, while still climbing slightly are, according to what we are being told, pretty much at the top of the hill. Plateauing shortly and then being reduced not long afterwards. In fact, this past week we saw a dip in 5-year fixed mortgage rates. First in a long time. And that’s good news.

The other thing that I find interesting, and which you’ll see from the chart above, is that in most of our major markets, based on populations: St. Catharines, Niagara Falls, Welland, Thorold and Grimsby, the average sale prices are all up, in spite of the upward shift in interest rates.

Overall, the average sale price across the Region sits about where it was at year end 2020. We’ve lost a lot of ground over the past year. But the fact remains that we are still up $152,176 or 32.0% from April 2020 when the pandemic started to take hold, and up a whopping $342,778 or 120.4% in the past 7 years. And when the average market price more than doubles in 7 years, that’s very good growth.

Now what about unit sales? What’s going on in that front? The numbers for January 2023 are very lack luster to be sure. Only 312 total sales across the Region. Of course, January is always pretty flat in real estate. By contrast, that total is down 160 units from January of 2022. A drop of 33.9%. But when you consider that last January saw probably the hottest market and the largest price gains in our Board’s history, being down 33.9% isn’t too bad. Especially when you consider most year over year drops in recent months have been around the 50% mark.

A lot of moving pieces in the early days of 2023 to be sure. Price and interest rate stability being the key factors. But I believe there is a pent-up desire on a lot of people’s part to get back into the market. They are just waiting for stability to return to the marketplace. I think the feeling is that properties are now underpriced. And that before long interest rates are going to make them more affordable. 2023 is going to be an interesting year to be sure. I’m optimistic of what lies ahead.