January 17th 2022

Last month we took a look at expenditures you might make on your investment properties in the way of repair, maintenance and upgrades, and we saw that those costs could be handled in one of two ways, depending on the nature of the work done. They could either be expensed or they could be capitalized. Expensed, we saw resulted in a dollar-for-dollar deduction against income, while capitalized items would add to the capital cost of the property. And that capital cost, could if you so chose, be depreciated over time. Today I’d like to look at that whole issue of depreciation.

Last month we took a look at expenditures you might make on your investment properties in the way of repair, maintenance and upgrades, and we saw that those costs could be handled in one of two ways, depending on the nature of the work done. They could either be expensed or they could be capitalized. Expensed, we saw resulted in a dollar-for-dollar deduction against income, while capitalized items would add to the capital cost of the property. And that capital cost, could if you so chose, be depreciated over time. Today I’d like to look at that whole issue of depreciation.

Pretty well every business has capital items they need to operate. A restaurant has stoves, fridges, walk-in coolers, an office has desks and chairs, computers, file cabinets, a rental operation has tools or cars or tuxedoes. And all these items are capitalized and depreciated, for the simple fact that one day they will wear out and have to be replaced.

The restaurant’s stove breaks down, the office computer becomes obsolete. Cars get old. The tuxedoes wear out. So, each year a portion of the capital cost is taken out against earnings in the way of depreciation.

When you own investment real estate you have a business. And as such you have items that are capital in nature. Bricks and mortar and the components that make it function. So, you too under the Canada Revenue Act are allowed to depreciate that capital investment. The difference however is that with real estate, the value doesn’t generally decrease over time. It increases. And that raises the whole issue of recapture. You see, with most business items, these depreciated items are eventually written off and replaced. But with real estate that doesn’t happen. So, some day upon sale or deemed disposition, those write downs are going to be repaid and that can be substantial.

Suppose for example you purchase a rental property for $500,000. As a general rule the government allows 25% for land and 75% for building. Land cannot be depreciated. So, in this case your undepreciated capital cost is $375,000. Depreciation is set at 4% of the depreciated balance annually. Now let’s suppose you depreciate the property for tax purposes each year for ten years. In the first year that gives you an expense of $15,000. Each year it decreases slightly. Over the 10-year period, the total depreciation would amount to $125,687.79.

So how does that impact you?

Well, let’s suppose after 10 years you decide to sell. I hope you don’t, but let’s suppose you do. At the moment capital gains are set at 50%. That means only half of the actual profit you make from the sale is subject to tax. But over and above that, you must deal with the depreciation, in the way of recovery. In this case another $125,687.79 must be shown as income on your tax return – recapture.

So, if you have to repay the full tax break is there really any point in ever depreciating a piece of rental real estate? Yes, in some cases. In fact in some cases it is almost a necessity.

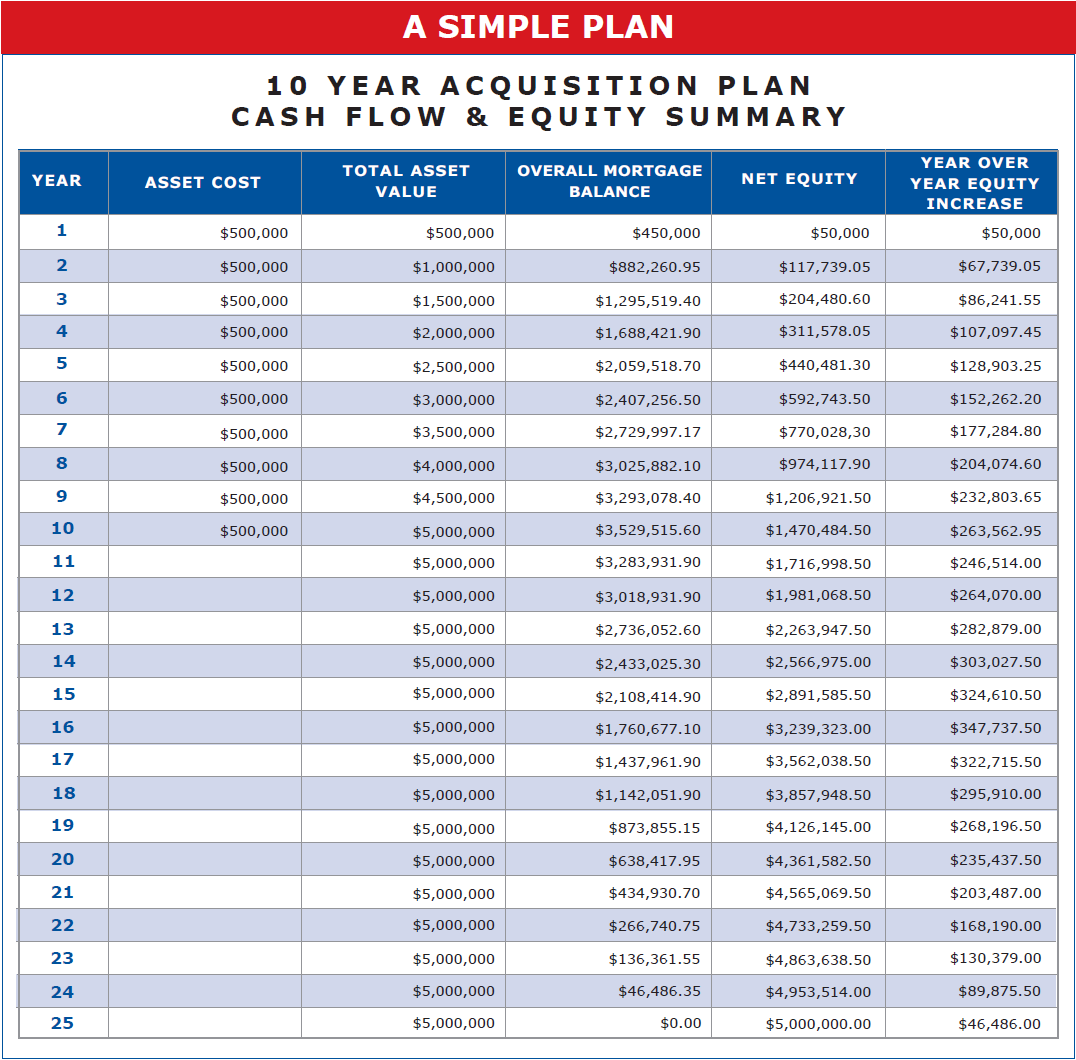

In my Money Machine seminars I espouse the idea of buying one property a year for 10 years and amortizing each mortgage for 15 years or less. Let’s suppose you do that. Again, for calculation purposes let’s suppose each property is purchased for $500,000 with 10% or $50,000 down. Have a look at the spreadsheet to see what happens with the mortgage balances.

You’ll see, on the second year for example, your year-over-year equity increase is $67,739.05. $50,000 of that is the down payment on your second property. $17,739.05 is what you have paid off your mortgage. Continue that year by year and look where you are at by year 10. $263,562.95 increase in equity. Now $50,000 of that again was down payment. But in that one year alone you’ve paid $213,562.95 off your mortgage. By year 11 that’s grown to $246,514.00 with no money put in for down payment because you stopped buying. By year 15 you are seeing $324,610.50 come off your mortgages.

And here’s the challenge. The government sees all that money as profit and subject to tax. Even though you didn’t get to hold any of it. It all went to the bank. And since it’s profit, you have to pay tax on every penny of it. Most of us, regardless of the level of income we enjoy, couldn’t handle adding another $324,610.50 to our tax return. At a massive tax rate of 53% that’s a further $177,043.56 in tax we’d have to pay. By depreciating our portfolio, we can at least cut that tax burden in half. And even though those numbers continue to grow, by year 16 one property is completely paid for and the money that would normally go to mortgage reduction is now available. Year 17 a second property drops off and so on.

Milestone 1 is year 10 when we no longer need to save for down payment, milestone 2 is year 15 when we pay off the first property. It just gets better and better from there. But it’s tough in the middle. The reason is taxes. You’ll need to plan. And in all probability, you’ll need to apply annual depreciation. It’ll make a huge difference. And it’s another good reason to never sell.

Wayne Quirk, Author, “THE MONEY MACHINE”, wayneq@remax-gc.com