January 16th 2023

There was a period of time in late summer, and early fall, when it appeared that prices in Niagara had stabilized. August, September, and October showed average prices in the Region being $695,328, $695,205, and $691,041 respectively. That puts the average during that 3-month period consistent within about 1/2%. A statistically insignificant variation. But that changed again now at the end of the year. In November we saw prices fall by $13,074 or 1.99% to $677,967 and again in December with the average sale price in Niagara coming in at $656,337 we are seeing another single-month drop of $21,630 or 3.2%.

So, at this point in time, we have to conclude that the price drop of residential homes in Niagara, while already significant, has once again continued its downward slide. Just how significant has the drop in prices been? How much ground have we actually lost? Here again, it varies significantly from one municipality to another, St. Catharines being especially hard hit. But looking at the Region as a whole, we ended the year 2021 with an average residential sale price of $752,221. Compared to December 2022, one year later, prices have dropped by $95,884 or 12.75%. But if we compare the price we ended the year at with the average regional sale price at the market peak ($863,057 in February 2022) we see the market has lost $206,720 or 23.95% and that’s in just 10 months.

If you look at any of the news reports discussing the price slide in Canada and especially in Ontario, they are stating that from the peak of the market, we have lost 10%-12%. They are way off. Here in Niagara as we see it’s closer to 25%. And looking at St. Catharines, which is the largest municipality in the Region, we see an even more drastic slide where the average sale price has fallen from the February 2022 high of $801,413 to its current $577,360, representing a drop of $224,053 or 27.96%.

Of course, all is not lost. If we go back to the start of the Pandemic, April 2020, when the first effects of the Covid clampdown were impacting the marketplace, a month which registered only 280 transactions, down by over 50% from the previous month, the average residential sale price at that point was $475,385 across the Region. Compared to then, we ended this year up $180,952 or 38.06%. So the pandemic spike in prices has not been totally lost with the recent softening in the market.

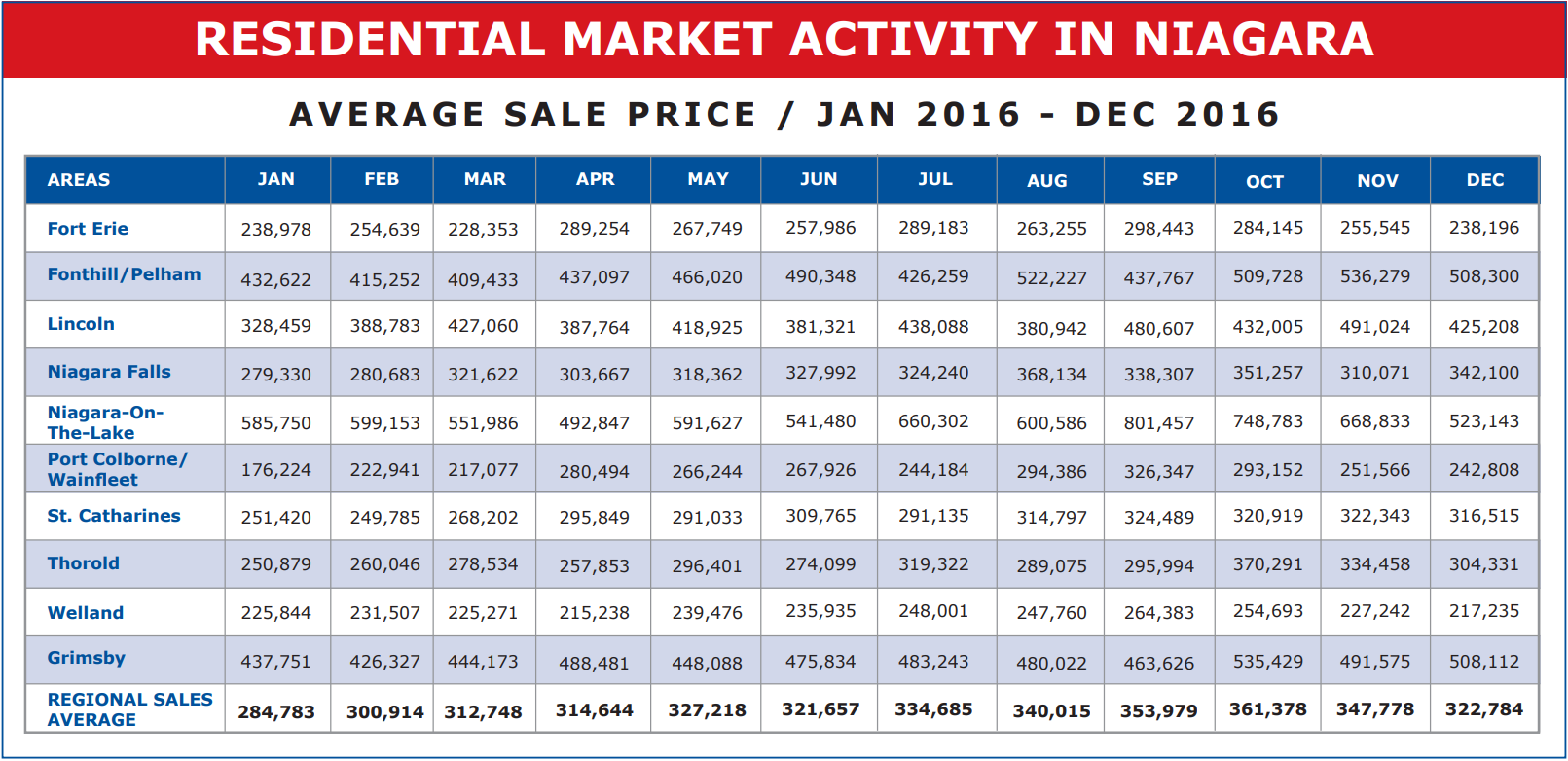

And, taking a broader look, by going back 5 or 6 years, we see that we ended the year 2017 with an average residential sale price of $405,858. By comparison, we are today up $250,479 or 61.7%, and compared to the $322,784 figure we ended the year 2016 at, we are up by $333,553 or 103.3%.

Now, had the increases in sale prices across the Region been steady over the last 5 or 6 years, I think we all would be feeling pretty good about things. 103.3% over 6 years, and 61.7% over 5 years, those are pretty good price increases. But the problem is that covid had an incredible impact on that steady upward trend. First by providing us an unprecedented spike in average sale price over a two-year period, followed by an almost equally incredible price drop in our post-Covid era. (January 2022 saw price increases of almost $100,000 from December 2021, followed in June 2022 by prices dropping by $100,000 in that single month).

So, what can we expect moving forward? That’s the $64K question. In many ways, we are in unchartered waters. Oh, we’ve had booms and bursts before. But never quite like this. And while we can’t blame the government for all our woes, like Covid, there is no doubt their approach to interest rates, as well as the foreign buyer clampdown, first at a provincial level with a crippling 25% surtax, followed by the Federal outright ban introduced January 1st, 2023, isn’t helping.

Sales figures, while not encouraging, seems to have stabilized. December 2022 registered 287 residential units sold across the Region, down 72 units or 20.0% from November. That’s not unusual for year-end. 2021 saw a drop of 186 units or 26.7% from November to December. But at this year's 287 we are still down 224 units or 43.8% from a year ago. Stable? Probably. But certainly, lackluster.

January, and perhaps more importantly the first quarter of 2023 will tell an interesting story. Can we expect further price declines? Have we stabilized? Will we remain mired in the doldrums of a recessionary climate for the next 4-5 years like we did in the early ’80s and ’90s or will the market rebound as quickly as it shut down? Those are questions only time will tell. Stay tuned. One thing is certain. In real estate, interesting times are ahead!