January 15th 2024

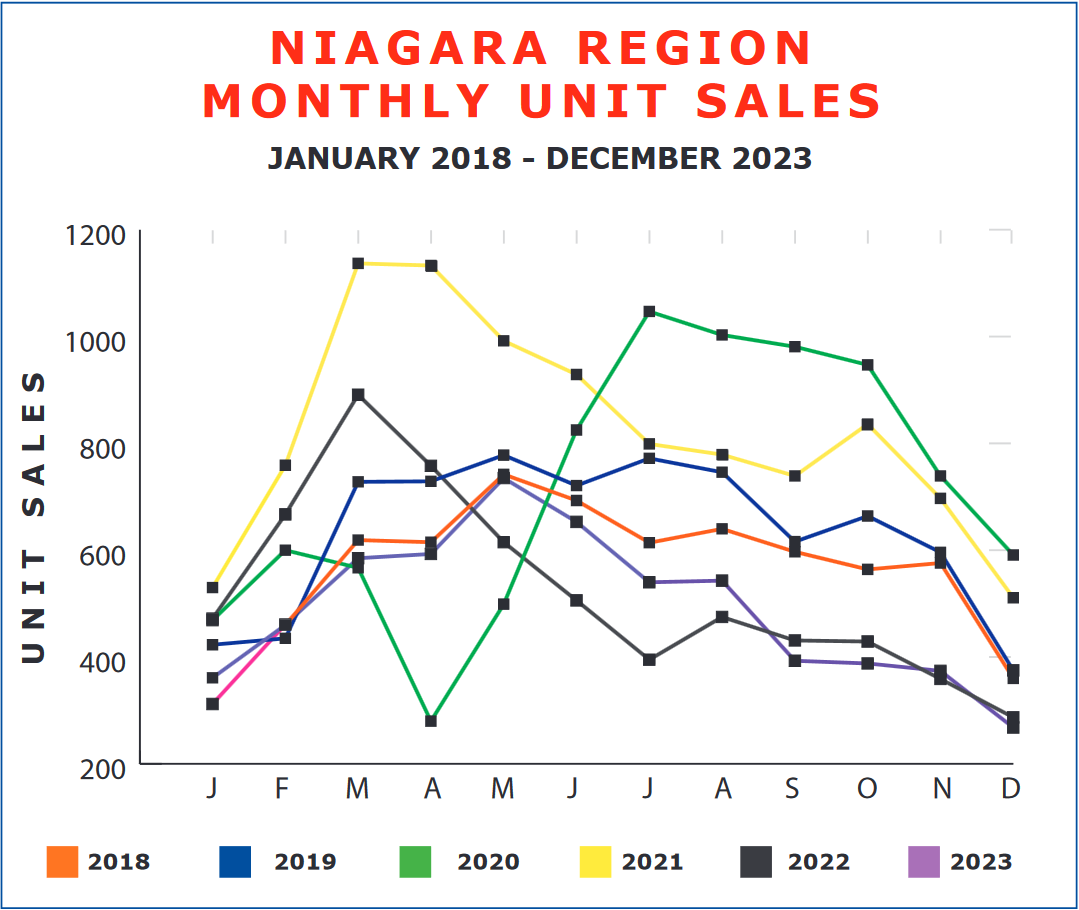

Looking back at market performance over the years, we see that while in rapidly appreciating markets like 2017, 2020 and 2021 it is not unusual to see prices continue to climb into December and January, that is not typically the case. In both declining markets and in stable balanced markets, we see prices decline at year end, and generally on into January as well. That pattern was seen in 2022-2023 and that is precisely what we are seeing again in 2023-2024.

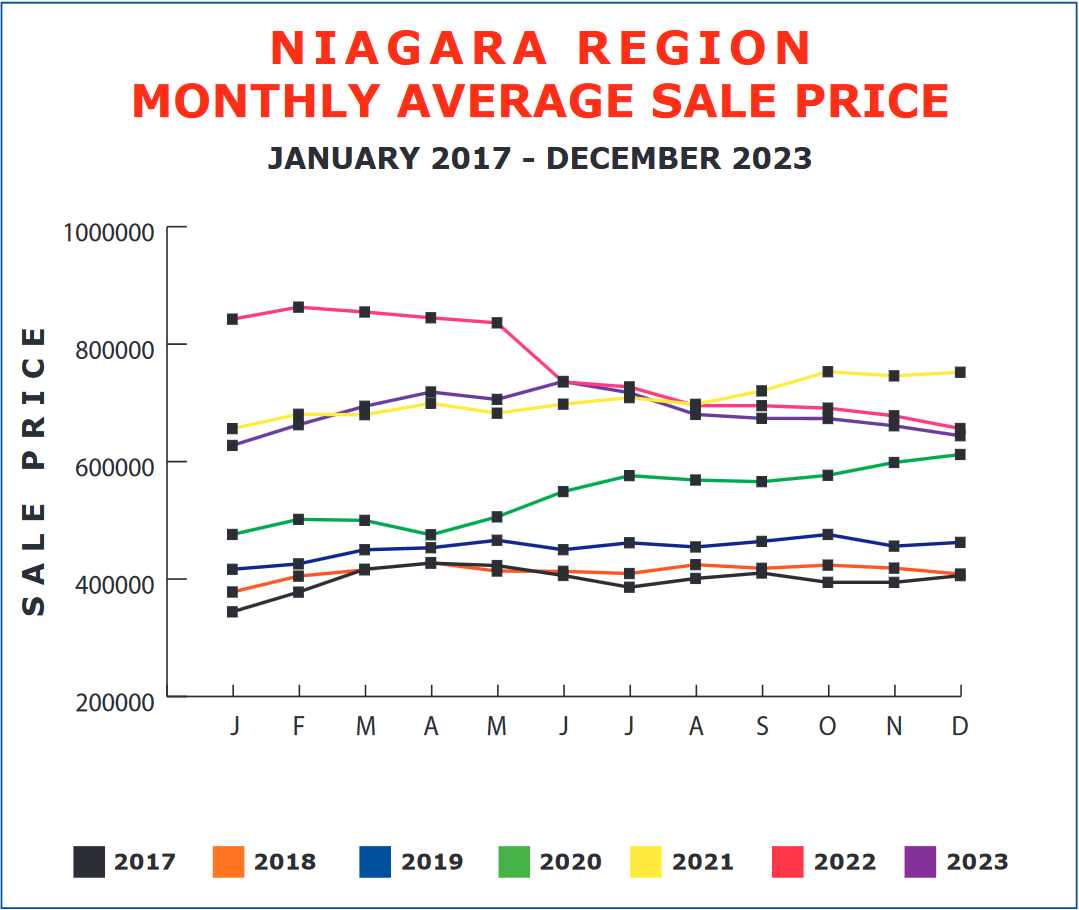

With the average sale price across the Region coming in at $644,067 for December, 2023 (a drop of $16,954 or 2.56% from November), we end up the year 2023 down $12,270 or 1.87% from one year ago but up $16,506 or 2.63% from where we started out this year back in January, 2023. Perhaps this trend can best be seen when displayed on a graph.

What leaps out at you immediately when looking at the graph is how far prices have fallen from their peak back in February, 2022. And if past patterns hold true, we can expect a bit more of a decline in January, 2024. But beyond that things should change.

Why do we say that? Why would we expect, after a 2-year slide in prices, to see things begin to turn around? Largely because of interest rate fluctuations.

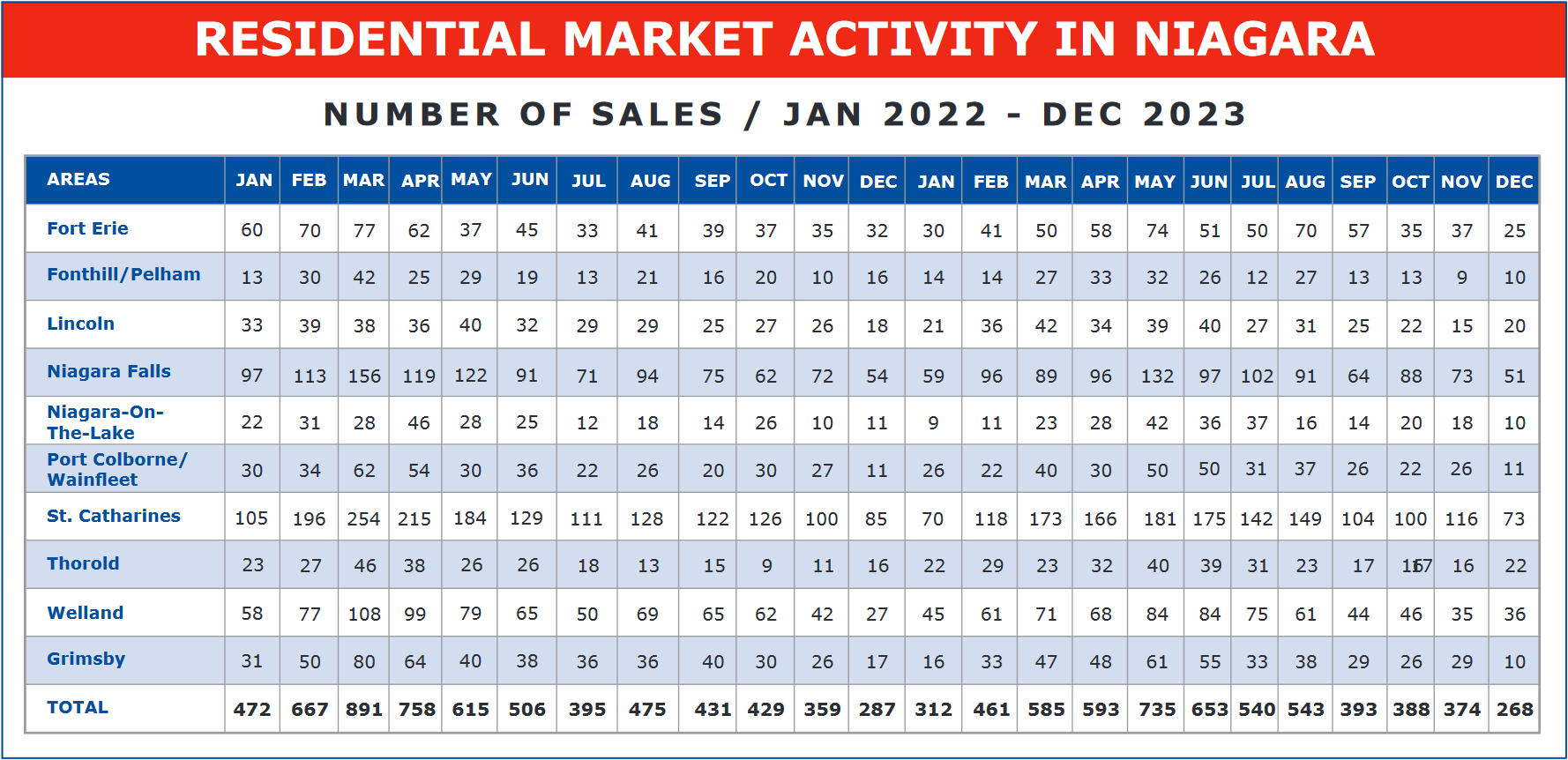

2023 has very much been the year of interest rate hikes. And this has put the brakes on the market for a couple of reasons. One is the fact that people are quite frankly being priced out of the market. The home you could easily qualify for when interest rates were running at or under 2% is simply out of reach when mortgages hover around 6% and another 2% is added for the ‘stress test’. But the other fact is that interest increases create uncertainty and anxiety. People don’t handle the change well and when in doubt, do nothing. This manifests itself in unit sales, which following a year of mediocre performance, simply dropped off the charts in December coming in at only 268 units.

That’s down a whopping 106 units or 28.34% from November and even underperforming December, 2022’s poor showing of 287 by 18 units or 6.62%

So why am I optimistic for 2024? A number of reasons. For one thing, the Bank of Canada seems comfortable with the notion that inflation has been tamed and are therefore committed to decreasing interest rates over the course of 2024. At least two banks have come out and forecast rate cuts in the 1 1/4 % to 1 1/2 % range over 2024. That’s very significant. That will open the doors to a lot of possibilities for people when they go to qualify for a mortgage.,

And the other thing is public sentiment. People have continued to express interest in real estate. They have been cautious while prices are in flux, but now with the prospect of price hikes as interest rates drop, I believe a lot of people who have been sitting on the sidelines watching and waiting will jump in. 2024. A slow start perhaps, but very much a market in recovery.