July 17th 2023

MARKET OVERVIEW - MARKET CONTINUES TO RECOVER

It’s always interesting to look at the numbers each month as they come in and see how they compare to the ‘feel’ of the marketplace. The numbers are now in for June and once again they seem to be giving a mixed picture. Let’s start with price.

The average price in the region came in at $736,491.

That’s encouraging. That’s an increase of $30,562 or4.33% from the $705,929 registered in May. That’s in just one month. It also puts us at almost exactly where we were one year ago ($735,708) and only down $126,566 or 14.66% from the peak of the market, $863,057 registered in February, 2022. And considering the fact that we ended the year December 2022 at $656,337, it means that in the first six months of the year we have gained $80,154 or 12.21% and considering the loss in value we suffered in January of this year, we are up from that $627,561 by $108,930 or 17.36%. When you consider how severely the market lost ground from the peak in February 2022, we have gained back almost half of the losses suffered. That’s the good news!

Unfortunately, not all municipalities have responded in the same fashion. The results continue to be quite fragmented. For example, the two largest municipalities in Niagara, St. Catharines and Niagara Falls, while being up in June over May are only up 1.23% and 0.34% respectively. Still both moving in a positive direction but not as drastically as the Region as a whole. And as you can see from the chart above, Fort Erie is down month over month $86,161 or 12.37%, while Niagara-on-the-Lake is up $253,328 or 25.54%. So it’s difficult to see a consistent pattern here. Yes, for the most part the market is moving upward and recovering a lot of the post-covid losses, but at the same time, it’s tough to forecast what tomorrow will bring to any particular municipality. People, buyers and sellers alike, are feeling their way along.

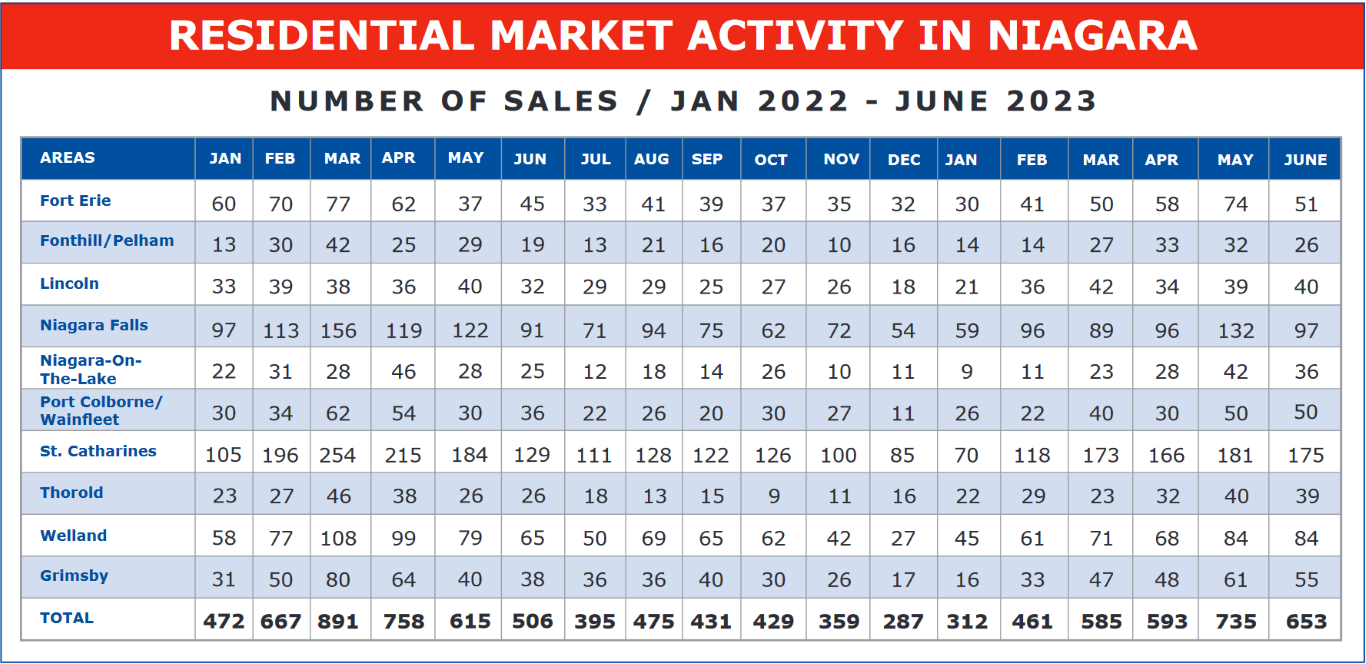

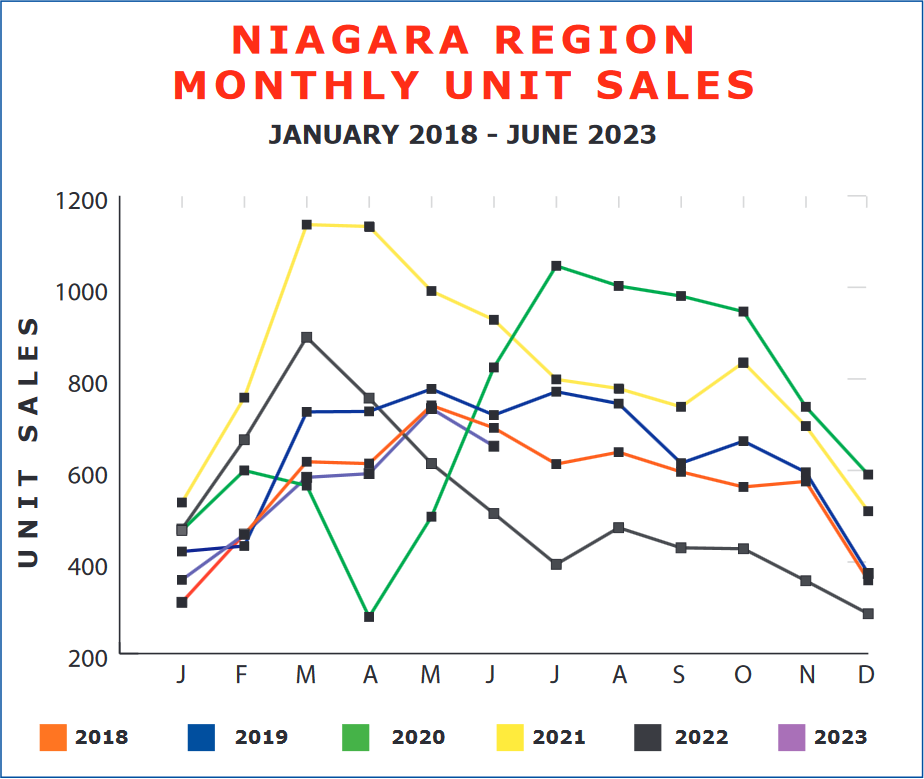

One very interesting stat to look at when trying to analyze the strength of the market is number of unit sale registered any given month. In June there were 653 residential units sold across the region. And while that’s down 82 units or 11.16% from the 735 units sold in May, it’s still the second highest month this year. And when you compare it to 2022 where 506 units were sold in June, it’s up 147 units or 29.05% from one year ago where June was the second worst performing month in the first half.

So, unit sales seem to indicate a higher confidence in the market over this time last year. Which makes sense when you consider that this time last year prices were in a decline, especially in June.

Of course, we can expect unit sales to continue to decline throughout the second half of the year. That is a seasonal response rather than an indication of market lethargy.

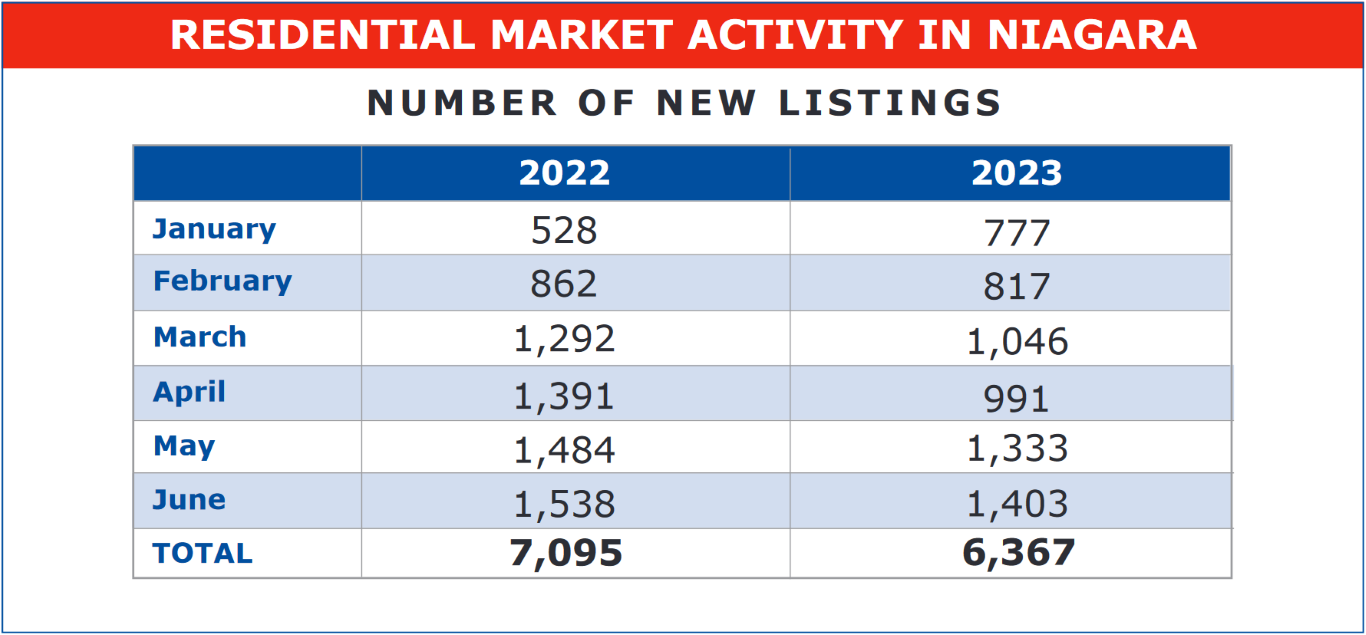

One last thing of note. Number of new listings. In June of this year we took in 1,403 new listings across the region. And while that’s not quite as strong as the 1,548 that came in one year ago, it is up 70 or 5.25% from May.

So the market continues to maintain a good balance of inventory available compared to sales made giving buyers some choice while providing adequate activity for sellers, especially when their properties are accurately priced. All in all, a recovering market operating in balanced territory but one that could see the fulcrum shift as investors become active once again.