June 16th 2025

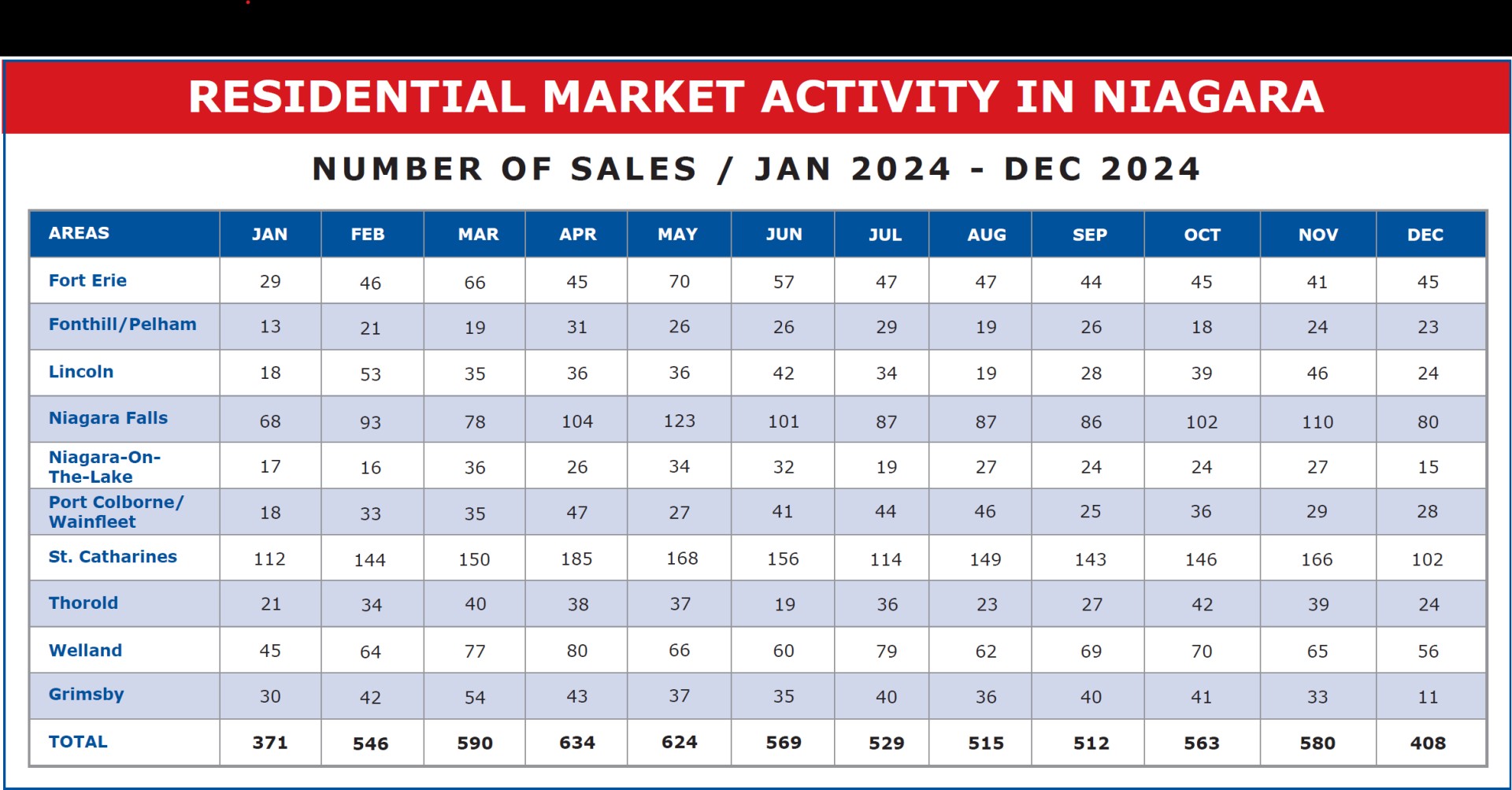

If this year follows the pattern of the past couple of years, we can expect a continued strengthening of market dynamics, both with respect to average price and also with unit sales right up to the end of June. But then a tapering off of both on to the end of the year. So, let’s take a look at May’s stats and see if that is what is happening.

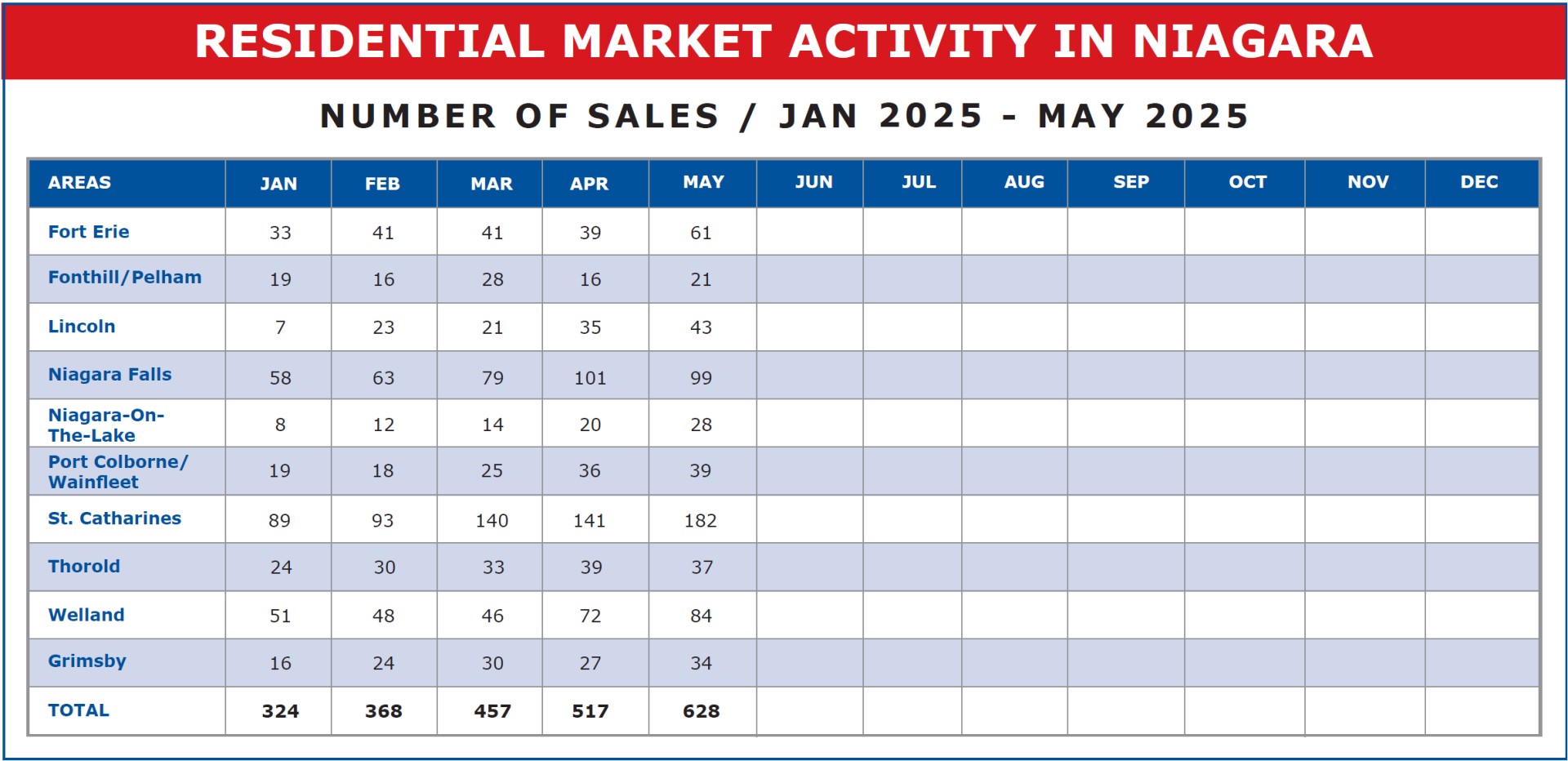

First on the activity front, we see that across the Region 628 sales were registered for May. That’s up 111 units or 21.5% from the 517 registered in April. And it is actually up 4 units from May 2024. However, it is down 6 units from last years record breaking month of April when 634 sales were registered. Not too shabby.

However, before we break out the champagne, we really need to see what June stats come in at. Is this a bit of a trend or is it one off? And as we have seen the activity tends to build to mid-year and then the gains we have seen begin to dissipate. As a real estate practitioner and in talking to agents out in the field, the sense is that things are unusually quiet. Properties that should be getting lots of showings just are not. Properties that are very attractively priced are getting action and, in some cases, multiple offers, but there is still a bewilderment and hesitancy on the part of buyers it would seem.

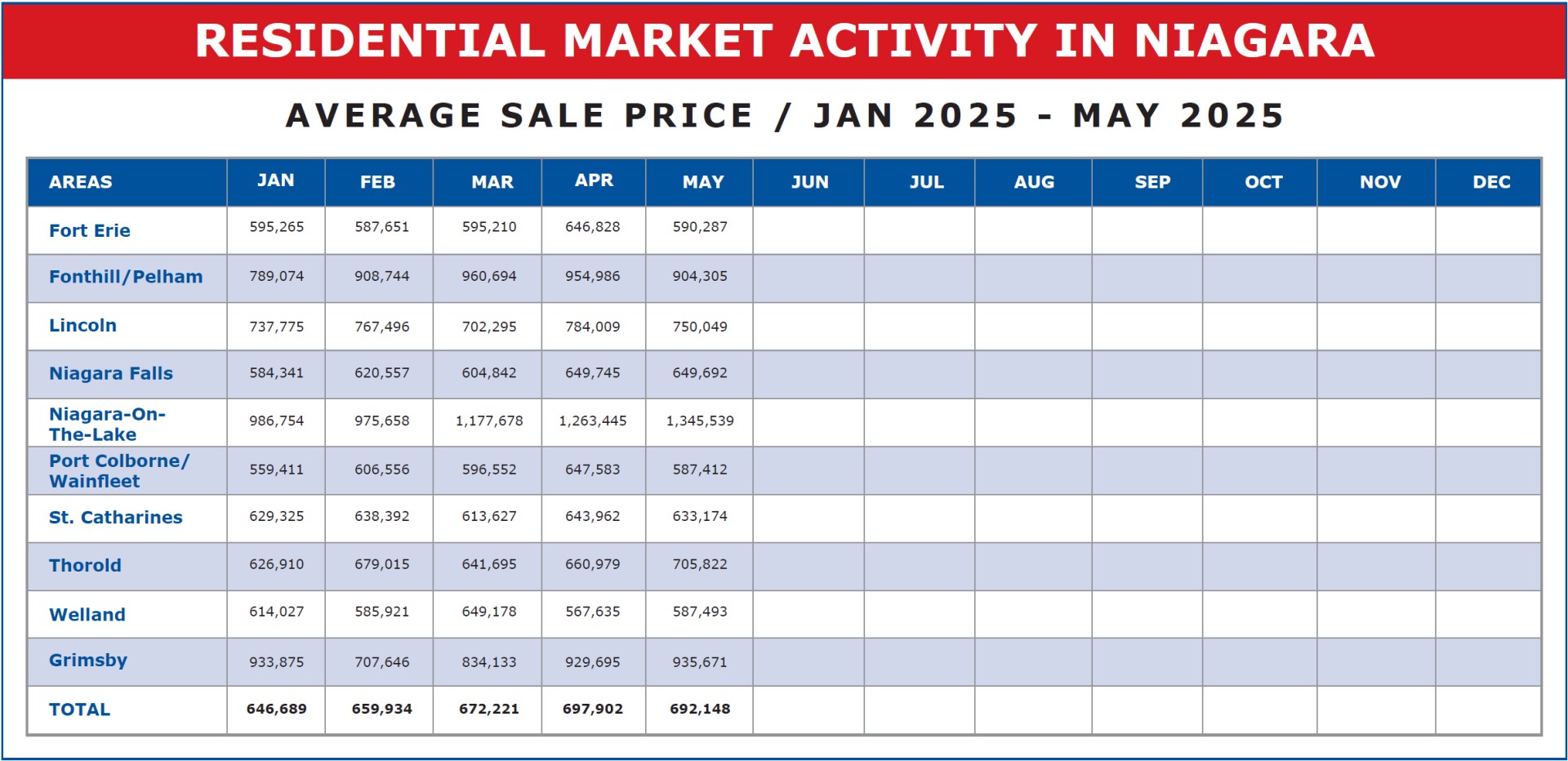

The other key factor of course is price. How did we fare there in May?

As you can see in May the average sale price across the Region came in at $692,148. Marginally lower than April (by $5,754), but still the second strongest figure registered this year. This is $45,459 higher than the $646,689 registered in January but substantially lower than the $706,771 registered one year ago in May 2024. And as for the fact that May slipped a little from April, I wouldn’t read too much into that. Last year April slid to $695,631 from the $711,751 figure recorded in March, but by June the average had climbed to $744,110 where it peaked for the year.

As we saw last issue, there are a lot of issues still floating around to concern consumers. Tariffs, interest rates, job stability. And, of course, having weathered a few downturns in the past I’m well aware that it’s generally a slow process climbing out. This year to date has been a little soft. But we are climbing our way back out. If the history of the past couple of years repeats itself, it will be a somewhat soft second half of the year, but we are in position for a turnaround and folks, it’s coming.