March 15th 2024

In the last newsletter, we saw that the first month of the year started off a little stronger than where it had finished in December. A gain of $6,111 to be exact. Not a huge gain, but it at least reversed a six-month slide in prices. I’m glad to report that February has come in again registering a gain. A very modest gain, but upward movement nonetheless. At $657,881, we are up $7,703 or 1.18% from the $650,178 recorded in January. And while much more modest, this follows the trend set in 2023 which saw gains registered over 5 of the first 6 months of the year.

What you may notice however is that these gains are not uniform across all municipalities. In fact of the 10 we follow 6 are up month over month and 4 are down. Part of that is reflective of the size of the municipality. The smaller the municipality the fewer sales are recorded and the greater the potential for one or two unusually large or small sales to skew the average. But it is also indicative of the fact that the market is still very uncertain. Look, for example, at the two largest municipalities, St. Catharines and Niagara Falls. St. Catharines is up $3,635.01 or 0.61% while Niagara Falls is down $17,467 or 2.80%. Next month that could well be reversed. There are just so many conflicting signals in the economy that people are uncertain as to what to do. They are watching the Bank of Canada, waiting to see when the promised and long-anticipated rate cuts will start to happen. They are monitoring carefully any announcements of rates of inflation hoping to see that drop down into the 2% - 2 ½% range. It’s not that they don’t want to get back into the real estate market. They have the desire. The question to them is when?

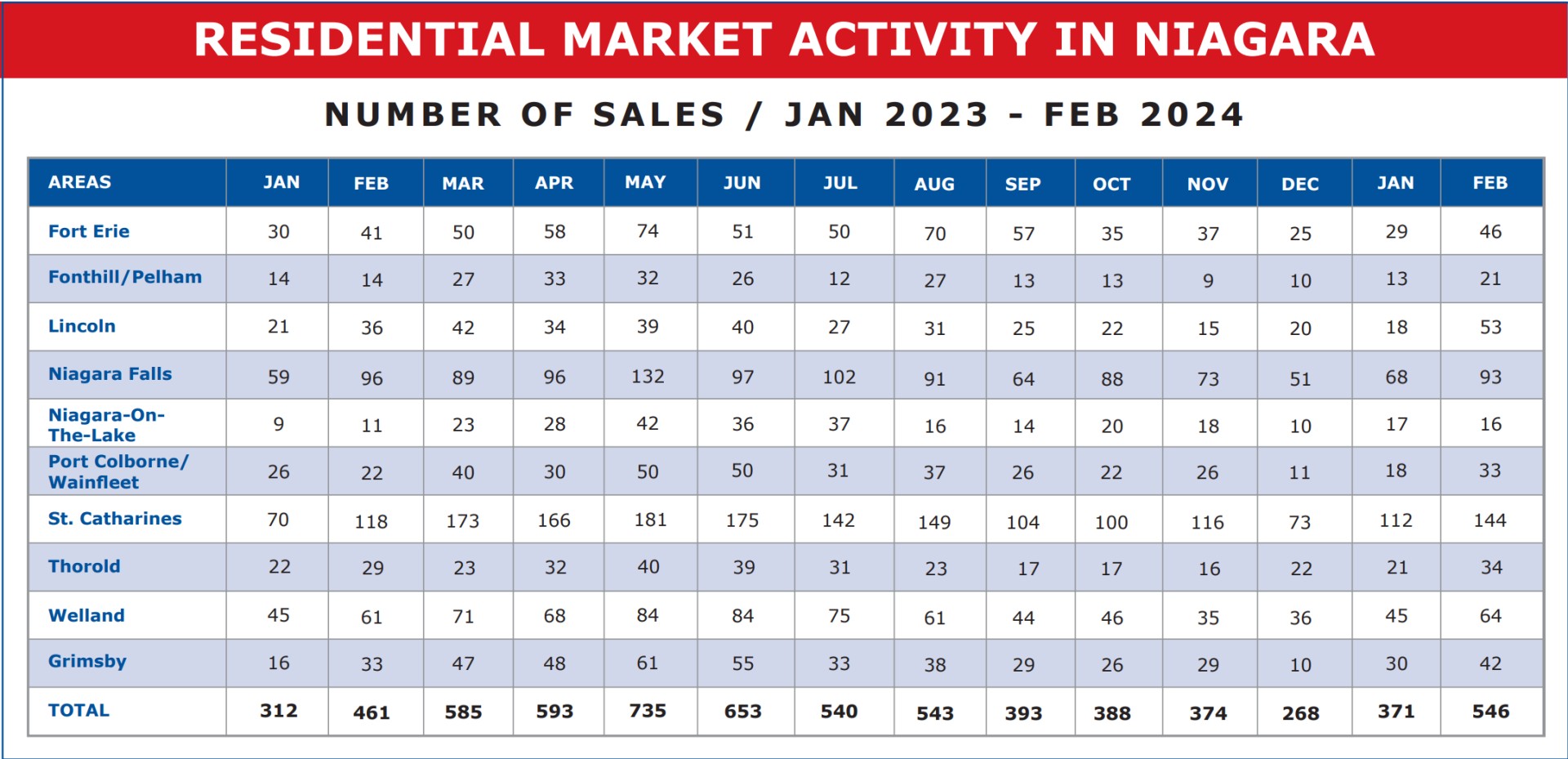

And interestingly enough, we are seeing more and more people jumping into the market now. Consider the unit sales report. We expect it to climb as we move into the spring. That’s a seasonal phenomenon. And we are seeing that happening again this year. What is interesting however is how much it is happening.

February saw 546 residential units sell within our Niagara Region. That’s up 175 units or 47.17% from January. Sizeable. But how for example does that compare to the first 2 months of 2023? January and February saw unit sales of 312 and 461 respectively. That reflects almost exactly the same increase as this year 47.76% from January 2023 to February 2023.

But when you look at year-over-year comparisons you see that January 2024 is up 59 units or 18.91% from one year ago, and February 2024 is up 85 units or 18.44% from one year ago. Is this due to the spring-like weather we have been enjoying this winter? Or is it reflective of more people anxious to capitalize on the market? Or a little of both?

I say capitalize on the market because I personally believe the time is excellent for buyers to get back into the market. And when I say buyers I mean everything from investors and end users to speculators. I think we all realize that when interest rates drop significantly this will open the doors to more buyers and that will mean rising prices and reduced selection. That hasn’t happened yet. And while interest rates are still relatively high, employing a short-term or variable-rate mortgage allows you to benefit from today’s prices and tomorrow’s interest rates.