November 16th 2020

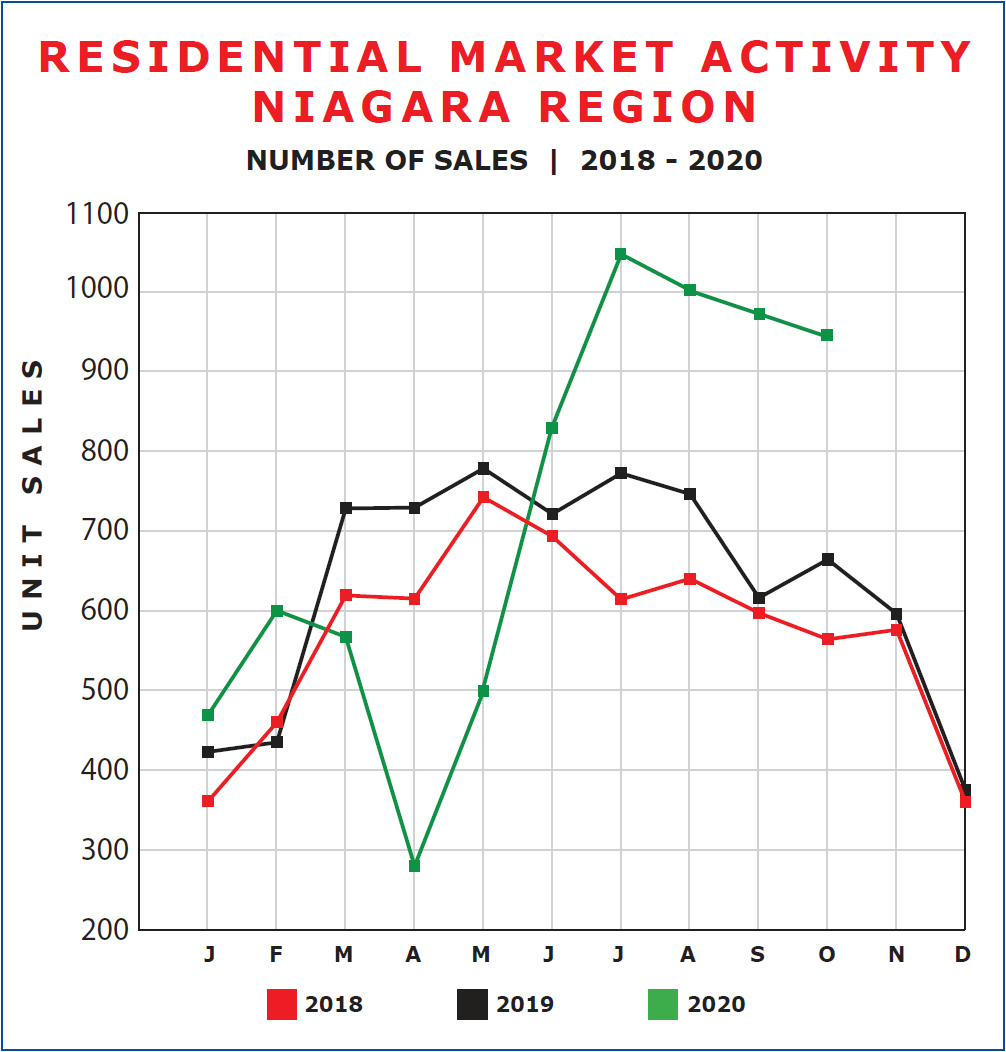

As expected, moving into the late fall and early winter months, the market activity slows somewhat. People are simply less likely to buy a home in December and January as compared with April, May and June.

*Sales data provided by the Niagara Association of Realtors and the Hamilton-Burlington Realtors Association as submitted through Brokerage Members inputted MLS sales.

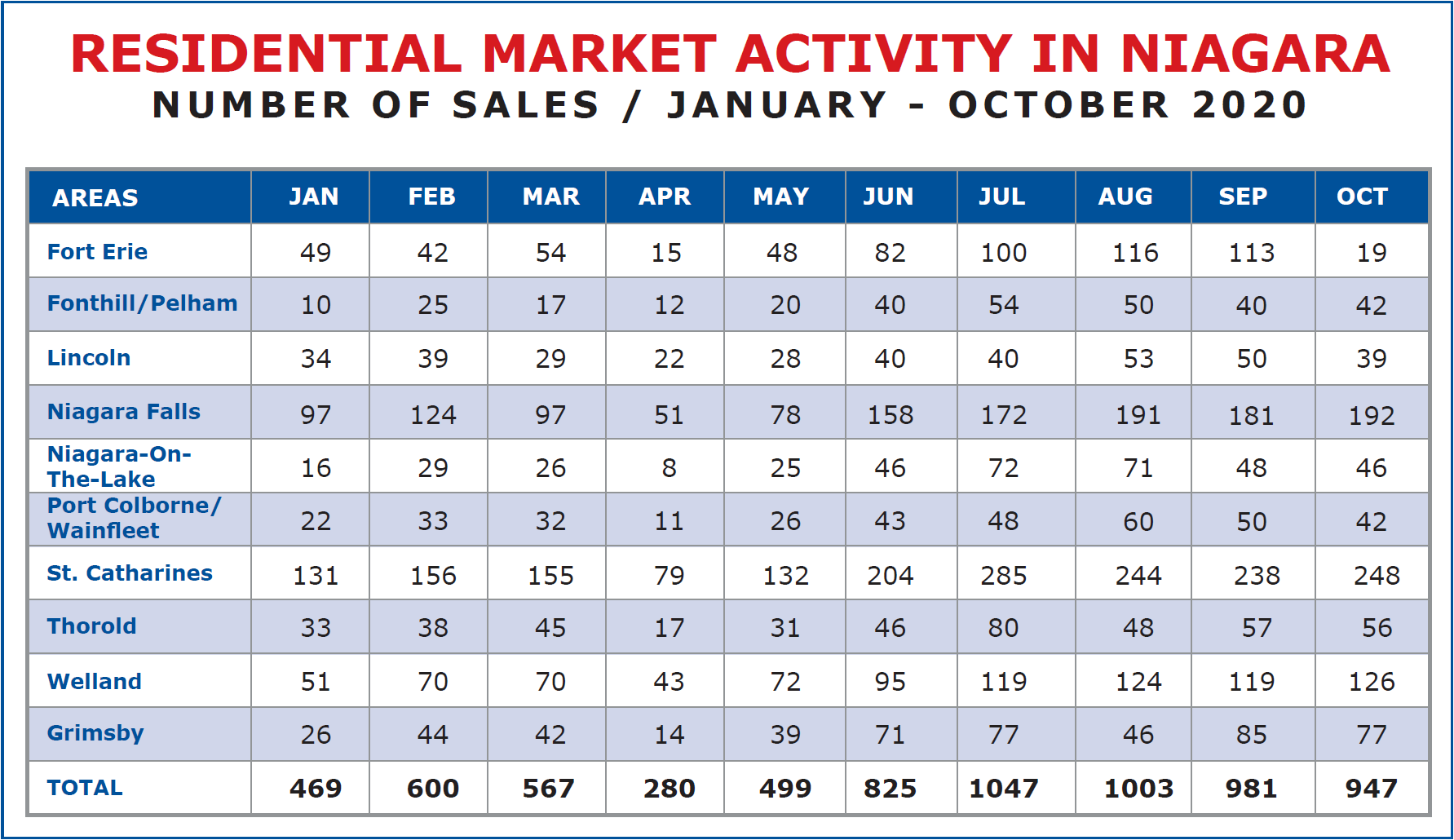

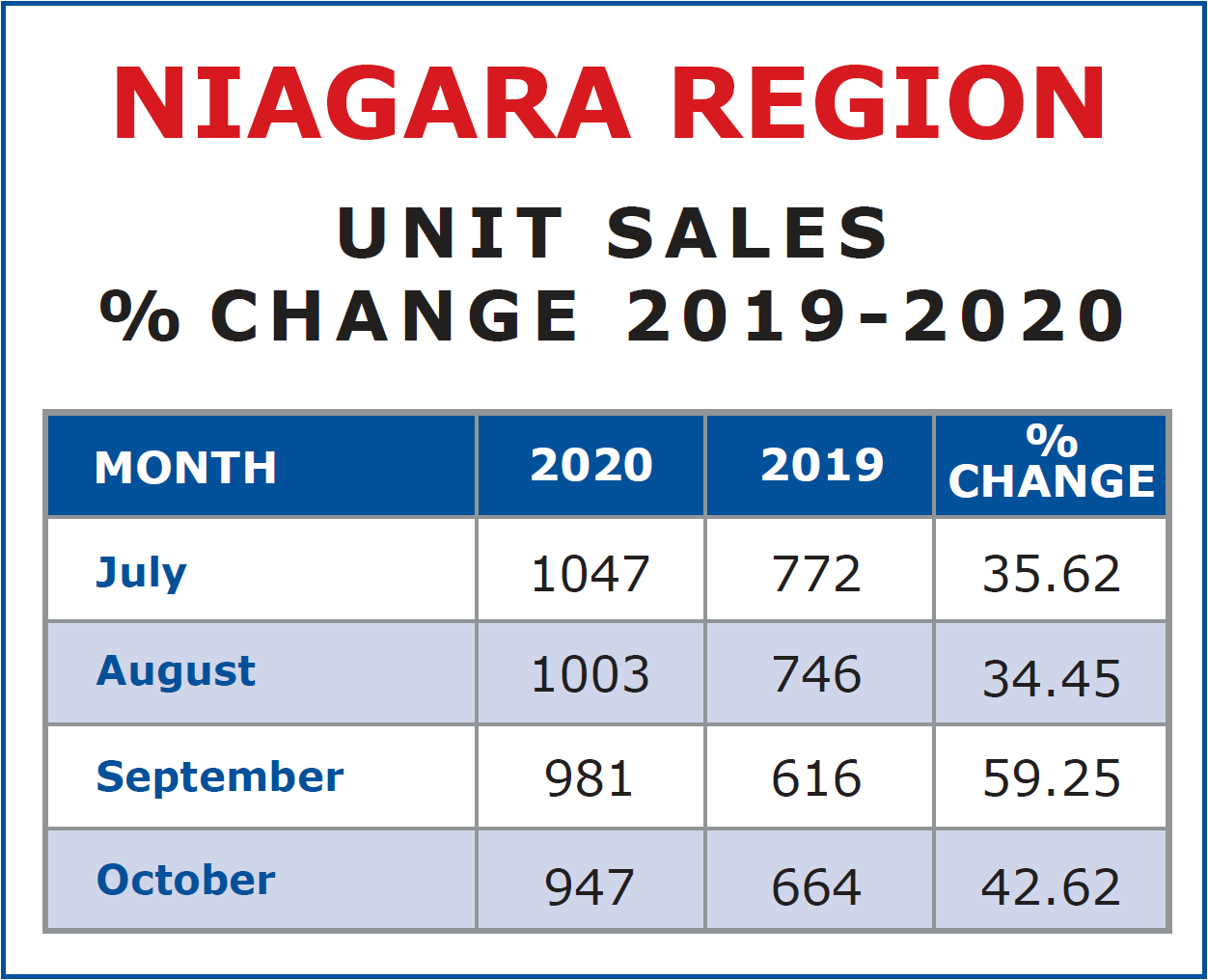

What is somewhat surprising is how gradual this deacceleration is this year. As we see, across the region 947 sales were recorded in October, down from 981 in September 1003 in August and 1047 in July. That represents a month over month slowdown of 4.2%, 2.2%, and 3.4% respectively. Incidentally, that represents an overall reduction in unit sales between July and October of 9.55% in 2020, compared to a slowdown over the same period in 2019 of 14.55%.

But what really illustrates the continued strength in the market is a comparison month to month between 2019 and 2020.

*Sales data provided by the Niagara Association of Realtors and the Hamilton-Burlington Realtors Association as submitted through Brokerage Members inputted MLS sales.

With the exception of two brief interruptions, first in the spring of 2017 when the foreign buyer spec. tax and the mortgage stress test for conventional financing slowed the market temporarily and again in the spring of 2020 when COVID-19 hit and paralyzed the economy, the market has been on a tear for the past five years. It has certainly been reflected in price increases which have seen the average residential price double in Niagara over that time period. But it has also moved unit sales into record territory and that activity continues to hold. The relative strength is easily illustrated in the accompanying graph.

*Sales data provided by the Niagara Association of Realtors and the Hamilton-Burlington Realtors Association as submitted through Brokerage Members inputted MLS sales.

There are a number of reasons for this activity. Homebuyers, whether first time, move up or scale down are recognizing and capitalizing on an extremely favourable climate for borrowing with mortgage rates running at below 2%. For many, with money so cheap, it’s just too good an opportunity to pass up.

At the same time, investors are looking for an opportunity to get some real gains. Something they can’t do with their money in the bank. With the cost of borrowing so cheap and when you factor in the compounding power of leveraging, real estate is the vehicle of choice, and with Niagara’s price gains leading the country, this is where many are looking.

Renovators too are seeing and seizing an opportunity right now. It’s an economic fact that people will generally pay more for a home that shows well, than the original cost plus the price of the renovation. But over the past couple of years with prices going up by 12-20% annually, there is a built-in-buffer that pretty well guarantees profitability.

All these components are active in the marketplace and as a result, the unit sale numbers have swelled far beyond what is the norm. Prices continue to rise on an annual basis. The regional average residential sale price for October 2020 came in at $576,711, up a modest 1.91% from the September figure of $565,878 but compared to the average of $475,935 in October 2019 that’s an astonishing $100,776 increase or 21.17%.

What can we expect moving forward? Well over the next 2-3 months we know there will be a slowdown in the volume of sales. That’s just a seasonal reality. And price gains, as we’ll see next issue is generally restricted to the first 6 months of the year, so prices should remain relatively stable into year-end. But with economists all forecasting record low-interest rates for the foreseeable future, we expect the market will catch fire again early in 2021.