March 16th 2020

After years of relatively flat performance across Niagara, we began to see the market pace quicken in 2015 – 2016. While 2014 recorded 6,703 total residential sales throughout the Region as reported through the MLS, by 2015 that number had risen to 7,736, an increase of 15.41%. Then in 2016 the total residential sales had grown to 8,912, a further increase of 15.20%.

And with the increase in sales activity, prices began to climb as demand outpaced supply. Multiple offers became the norm. Added to the mix of first-time buyers, move-ups, empty nesters and people new to the area, we began to see speculators, renovators and investors flock to the market. All this caused the market to spin almost out of control. We’ll look a little more closely at price trends in just a moment, but sufficient to say by 2017 we had a very robust market in Niagara.

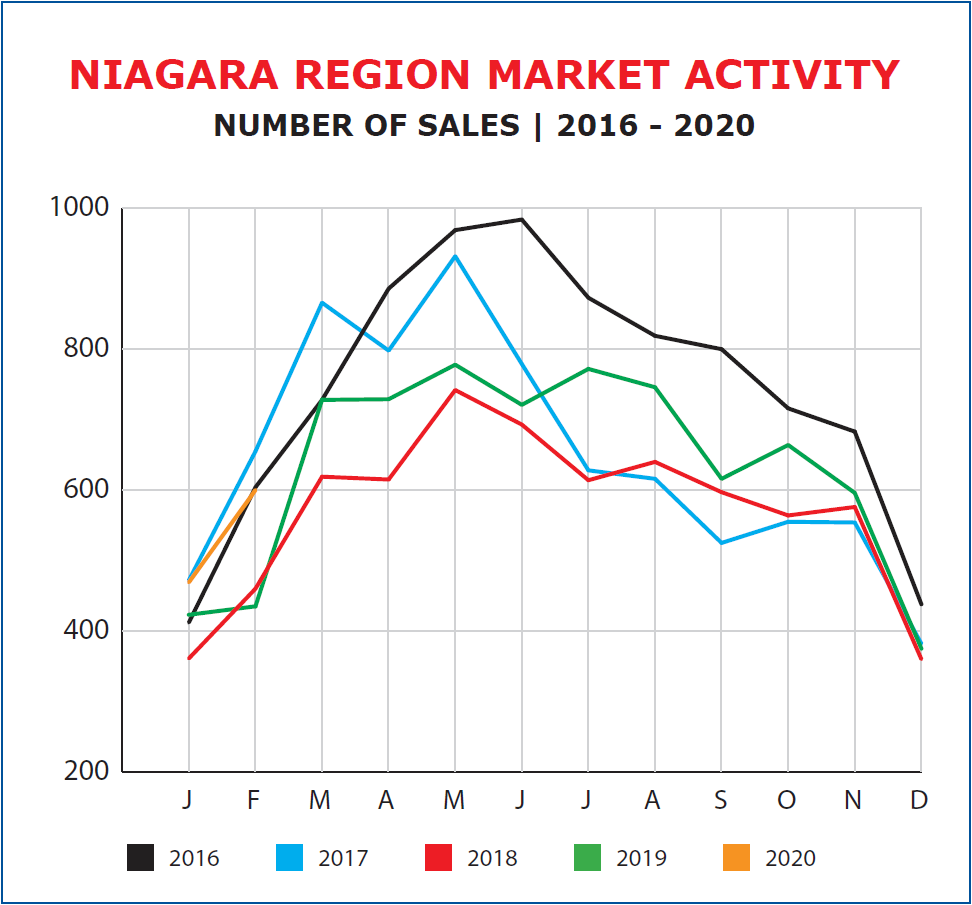

Let’s take a quick look at sales activity as depicted on the graph below.

As you can see, 2016 showed a very active market, and while sales peaked in the spring and dropped off toward the end of the year, as is the norm, overall it was a very busy year. 2017 began the year at an even busier pace than 2016, but then as we are all aware, the government stepped in in April with the introduction of the foreign buyer’s spec tax and the stress test for conventional mortgages. As a result, sales activity dropped off drastically over the 3rd and 4th quarters of the year.

The lacklustre performance in the marketplace continued through 2018 where a total of only 6,841 residential sales were recorded in Niagara, returning it to 2014 levels, a drop of 23.3% from the heady days of 2016.

A lot of people felt that the hot market of 2016 and early 2017 were gone for good. I recall a conversation I had with one of my agents who told me he felt 2017 was a one-time phenomenon that would never be repeated. But that is proving not to be the case.

The fundamentals of the marketplace in Niagara are still very strong. Relatively low prices at least by Golden Horseshoe standards. Record low-interest rates. Spiking rental rates, and upward momentum. As a result, and as is evidenced in the previous graph, 2019 saw sales figures came in at a very respectable 7,583 units. Not the 8,912 total we saw in 2016 to be sure, but a healthy 10.85% above 2018. And look at the first two months of 2020, where sales numbers are actually above the first two months of 2016.

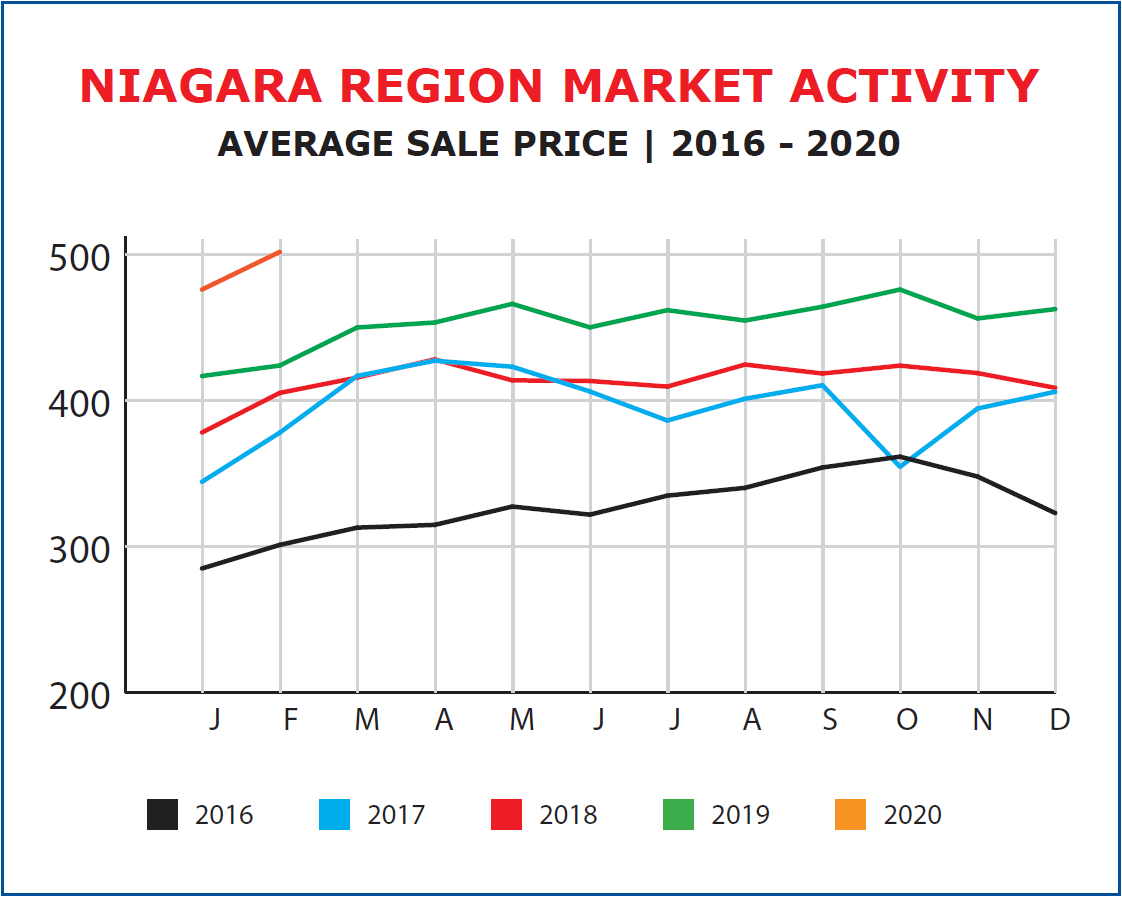

A very significant contributing factor to the increase in sales activity is the fact that prices are once again on the rise. Have a look at the average residential sales prices across Niagara for 2016 to date as shown on the graph below.

As you can see, prices in 2016 were on the rise, except for the last couple of months. 2017 began higher than the peak of 2016, gained strength well into the spring, and then slid over the balance of the year. 2018 was relatively lacklustre as far as price gains were concerned but the year did overall come in with higher prices than 2017. But then look at 2019. Not only does it reveal significantly higher prices than in 2018 but it also shows a steady increase throughout the year. And of course, with the increased momentum, your fringe players, the speculators, renovators and investors flock back into the market anxious to benefit from the steady rise in prices.

And look at prices registered for the first two months of 2020! A strong start to the year, to say the least. And while it’s always a challenge to see too far into the future, the indicators all suggest that 2020 is going to be a record year. As of this writing, the Bank of Canada has just cut its prime lending rate by ½%. This will certainly be translated into a corresponding reduction in mortgage rates. And economists are predicting another ¼% cut in April. Providing there are no unexpected outside interference to the marketplace, 2020 could eclipse 2017 both in sales volumes and in price increases.

We’ll revisit both these graphs as the year unfolds, but hang on to your hats. We’re in for quite a ride in real estate in Niagara over the days and months ahead.