December 15th 2019

There are two schools of thought when it comes to building an investment portfolio composed of residential real estate. One is the idea that positive cash flow should be enjoyed today. It should be used to supplement your income and help you enjoy life more fully. To that end, the acquisitions are structured with mortgages amortized as long as possible. You aren’t trying to pay them off and so you want as little going toward retiring the debt as possible and that money directed into your pocket now.

There are two schools of thought when it comes to building an investment portfolio composed of residential real estate. One is the idea that positive cash flow should be enjoyed today. It should be used to supplement your income and help you enjoy life more fully. To that end, the acquisitions are structured with mortgages amortized as long as possible. You aren’t trying to pay them off and so you want as little going toward retiring the debt as possible and that money directed into your pocket now.

The other approach is quite the opposite. Here the goal is not positive cash flow to supplement your income, but rather positive cash flow to pay down the mortgage. Your philosophy is that you don’t necessarily need more income today, although of course, everyone could use a little extra. But here the goal is to get those rental properties paid off as soon as possible so that you can enjoy a revenue stream upon retirement. It’s the case of instant gratification verses deferred gratification. And while neither approach is right or wrong, I’m a strong advocate of the latter. Tighten the belt today and enjoy the benefits down the road.

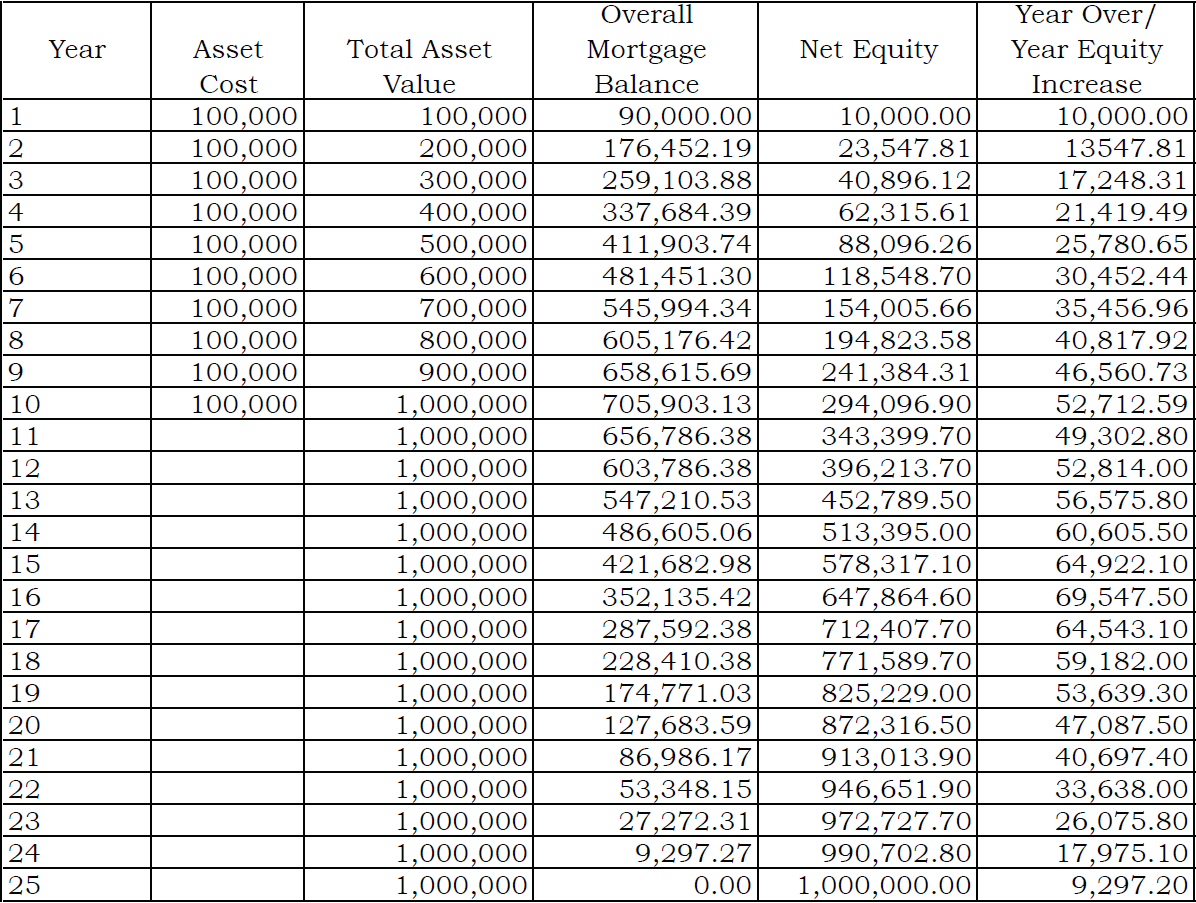

That’s really the premise behind the Money Machine. If you’ve followed along the series of articles in this  newsletter or taken one of my seminars, perhaps you’ll recall the Simple Plan I laid out: 1) Purchase one property a year for 10 years; 2) Never amortize for more than 15 years; 3) Never sell. Do this and you’ll enjoy a very prosperous retirement.

newsletter or taken one of my seminars, perhaps you’ll recall the Simple Plan I laid out: 1) Purchase one property a year for 10 years; 2) Never amortize for more than 15 years; 3) Never sell. Do this and you’ll enjoy a very prosperous retirement.

A simple plan – but not necessarily easy. There are a lot of challenges along the way, and one of those very real challenges is paying the taxes on the revenue you receive, especially since the bulk of the money is going toward retiring the debt.

In the Money Machine seminar I illustrated the Simple Plan of acquiring 10 properties at an aquisition cost of $100,000 each. That was done for ease of calculations. You can’t acquire a property for $100,000, of course. But even if you could, in the middle of the plan you are paying down the debt at the rate of about $50,000 a year.

In actual fact with properties running more in the range of $300,000 - $400,000 you might be retiring $150,000 - $200,000 debt per year. All funded from rent. But since that money is going against debt it is not an expense in the eyes of the government. It’s profit, and it’s taxable.

So imagine when you are doing your income tax you have got to show added income of $150,000 to $200,000 on your tax return. How are you going to handle the accrued tax? A very real problem. Had your approach been instant gratification rather than delayed gratification you would have the cash in hand, but since this is a retirement project, the money is going to the bank each month. A very real problem and one that you will have to come to terms with.

So imagine when you are doing your income tax you have got to show added income of $150,000 to $200,000 on your tax return. How are you going to handle the accrued tax? A very real problem. Had your approach been instant gratification rather than delayed gratification you would have the cash in hand, but since this is a retirement project, the money is going to the bank each month. A very real problem and one that you will have to come to terms with.

Four things come into play that can help.

One is that over time rents do increase. You will find that not all the money goes into servicing the mortgage. There will be some surplus and each year that will increase.

Secondly, once you hit year 11, and that’s where you really start seeing your mortgages pay down, you no longer need to save and acquire more property. But you have been generating saving all along. Now instead of that money going to a downpayment, it can be used to bolster up your tax account.

Thirdly, at year 16 your first property is completely paid off. Now you have significant surplus and that surplus will grow by one more paid off mortgage each year. Significant revenue can now be applied towards taxes.

And finally, the government allows you to depreciate your rental properties each year. What you do here is allocate a portion to land cost and a portion to building cost. You can’t depreciate the land portion but you can the building, creating a paper loss. And that stated loss can be applied as an expense against declared profit.

Now I should point out that by depreciating your properties you are not avoiding taxes. You are deferring them. Whenever the property is sold, or passed on in your estate as a deemed disposition, there will be both recapture and capital gains to be paid. The government is going to get paid at some point but by utilizing the annual depreciation provision, you are greatly reducing the tax burden in those critical years while mortgages are in play.

Wayne Quirk, Author

“THE MONEY MACHINE”

wayneq@remax-gc.com