September 15th 2021

Over the past 5 years, property values have gone up. A lot! In fact, here in Niagara, we’re told prices are up a whopping 135%. And along with that upward movement on prices rental rates have skyrocketed as well. But that’s  market rent. Actual rental rates have not fared so well. Each year the government of Ontario sets the maximum amount a landlord can increase his rent and that amount is generally below 2%. This year in fact it's 0%. So at best a landlord can barely keep up with the rate of inflation. There’s no hope of ever catching up to market rents where any of his units have long-term tenants.

market rent. Actual rental rates have not fared so well. Each year the government of Ontario sets the maximum amount a landlord can increase his rent and that amount is generally below 2%. This year in fact it's 0%. So at best a landlord can barely keep up with the rate of inflation. There’s no hope of ever catching up to market rents where any of his units have long-term tenants.

This becomes especially critical when a property changes hands. Either chronic low rents prevent the owner from ever getting the price he should for his rental property, or the new owner can’t possibly cover the carrying cost of the newly acquired property with the existing rent. Or a combination of both.

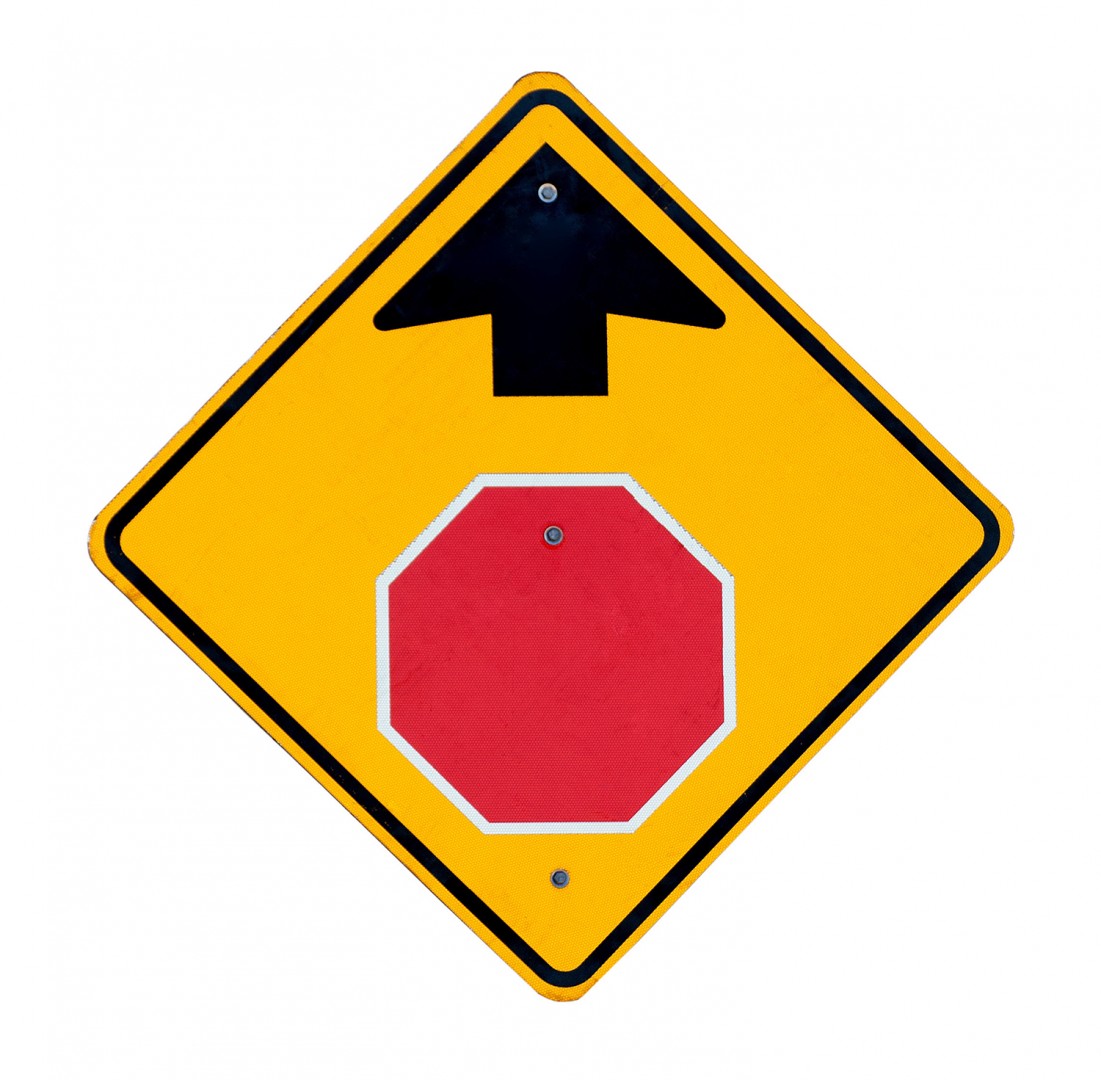

As a result, there is a lot of pressure on the part of buyers and sellers to get substantial rent increases, and generally, this involves a change of tenants. There are a number of tactics used, and most of them are dangerous and need to be avoided. Let’s explore a few.

Option 1 – Negotiate a higher rent with an existing tenant. In this situation, the landlord goes to his tenant and explains that he is putting the property up for sale because the rents are too low for him to be profitable. The tenant doesn’t want to move. Realizes that the chances are good, especially in the case of a single-family  residence, that a new owner will require vacant possession and offers to pay more if the current owner would consider not selling. Sounds like a reasonable compromise. The problem being that this arrangement is not enforceable or supportable by the Landlord and Tenant Board. If after the fact the tenant appeals to the Board, the Board will roll back the rent and require the Landlord to return the overpayment.

residence, that a new owner will require vacant possession and offers to pay more if the current owner would consider not selling. Sounds like a reasonable compromise. The problem being that this arrangement is not enforceable or supportable by the Landlord and Tenant Board. If after the fact the tenant appeals to the Board, the Board will roll back the rent and require the Landlord to return the overpayment.

Option 2 – Evict the tenant using an N12 stating the property is needed for personal use. Then in a short time re-rent the unit at market rent. An existing landlord or in the case of a sale, the new landlord needs to be very cautious about this. An N12 should be used in cases where the unit is honestly needed for personal use. At the very least a qualifying family member needs to occupy the unit for a minimum of 12 months. If the evicted tenant discovers the landlord issued the N12 but did not follow through with a family member occupying the unit, he can appeal to the Board up to 12 months after his eviction and the landlord (past and present) can be liable for a fine up to $50,000 in the case of an individual or $250,000 in the case of a corporation.

Option 3 – Evict the tenant by using an N13 “Notice to End your Tenancy Because the Landlord Wants to Demolish the Rental Unit, Repair it, or Convert it to Another Use”.

Suppose you own a triplex where one unit was once used as a small commercial space, perhaps a hair salon. In the past, it’s been converted to a bachelor apt, but the owner wants to convert the unit back to commercial use. Assuming the zoning is right, this would be a permissible reason to use an N13 and evict a tenant.

However, often a new landlord will use an N13 to gain vacant possession. Then renovate the unit with the intent of re-renting it still as a residential dwelling, but now at a much-increased rent. Be careful of this! Under the law, the evicted tenant has the first right to re-rent the unit at the original rent plus perhaps a minimal increase (in the 5% range with Board consent). If the unit has already been rented the landlord will be required to offer him another suitable unit and/or be liable for a substantial fine as we’ve previously discussed.

Option 4 – Negotiate the tenant ending the tenancy by using an N11 “Agreement to End the Tenancy”. This is really the only safe and viable option if the goal is to re-rent the unit at increased market rent. But it's not as easy as it sounds. I spoke to a colleague of mine who had a number of units that were substantially below market rent. He went around to each of his tenants and offered them $5,000 in cash if they would move out. Not one of them took him up on his offer. And why would they? Suppose market rent is $1,450 and they are paying $900 for the first one year, the rental differential is $6,600. Unless they have plans to move soon anyway or are in desperate need of cash, they are staying put. So, this legal option may not be as simple to accomplish as it sounds.

In short, there are a lot of chronically low rental units in existence at present and a lot of stigmatized properties as a result. But unless or until legislation changes, (and don’t hold your breath on that happening) there isn’t a lot a landlord can do about it. And you need to know what you are doing and proceed with caution where you are enacting an eviction and increasing the rent is your ultimate goal.