May 15th 2024

Another month has come and gone. What exactly has happened in the real estate market across Niagara over that time? Nothing startling I’m afraid. As we’ll see, average sale prices and number of units sold, while both inching up aren’t really registering any significant change.

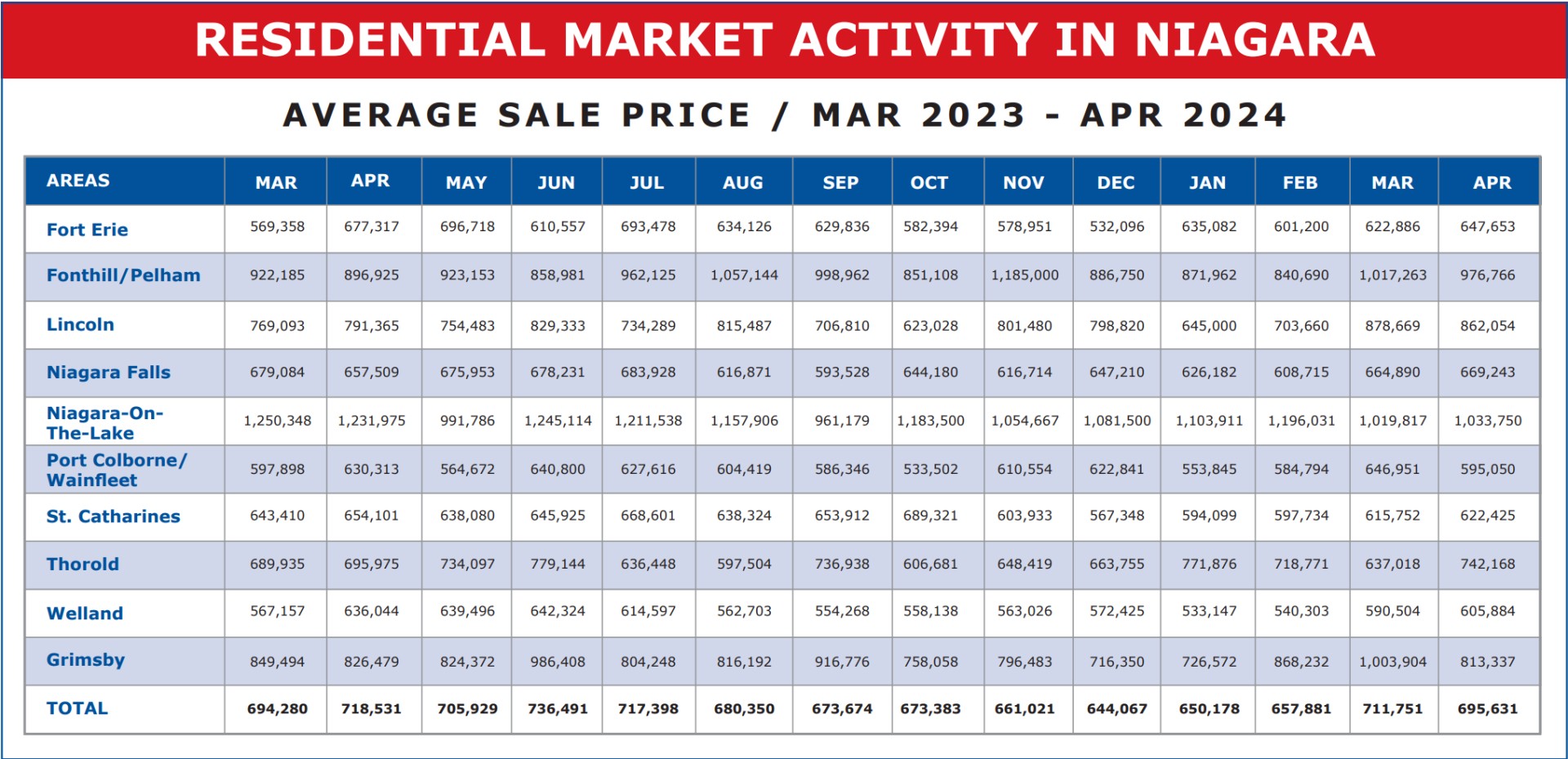

At $695,631, Niagara’s average residential sale price came in actually $16,120 or 2.26% below last month. But compared to where we were in January, we are up $45,453 or 6.99%. And contrasted with the $644,067 average price we ended the year 2023, we are actually up $51,000 or 7.92%

Drilling down to the individual municipalities and comparing their month over month performance you get a real mixed picture. About half the markets we follow in the region registered month over month gains for April while the remainder lost ground. And as you can see overall, the prices are rising from the start of the year, which is what we’ve come to expect in the first half of the year but at a more modest rate than we saw in 2023. As we have seen, the first four months of this year saw average prices grow by $45,453, but in the same four month period last year, average prices rose by $90,970. Exactly double the dollar increase of today.

By my way of looking at things I’d say we have just completed two full years of recession in real estate. April 2022, when a slowdown first occurred, average sale prices in the region were sitting at $844,887. One year later, April 2023 prices had fallen to $718,531, and today we’re coming in at $695,631. All indications are that things have bottomed out with the occasional up tick coming into play.

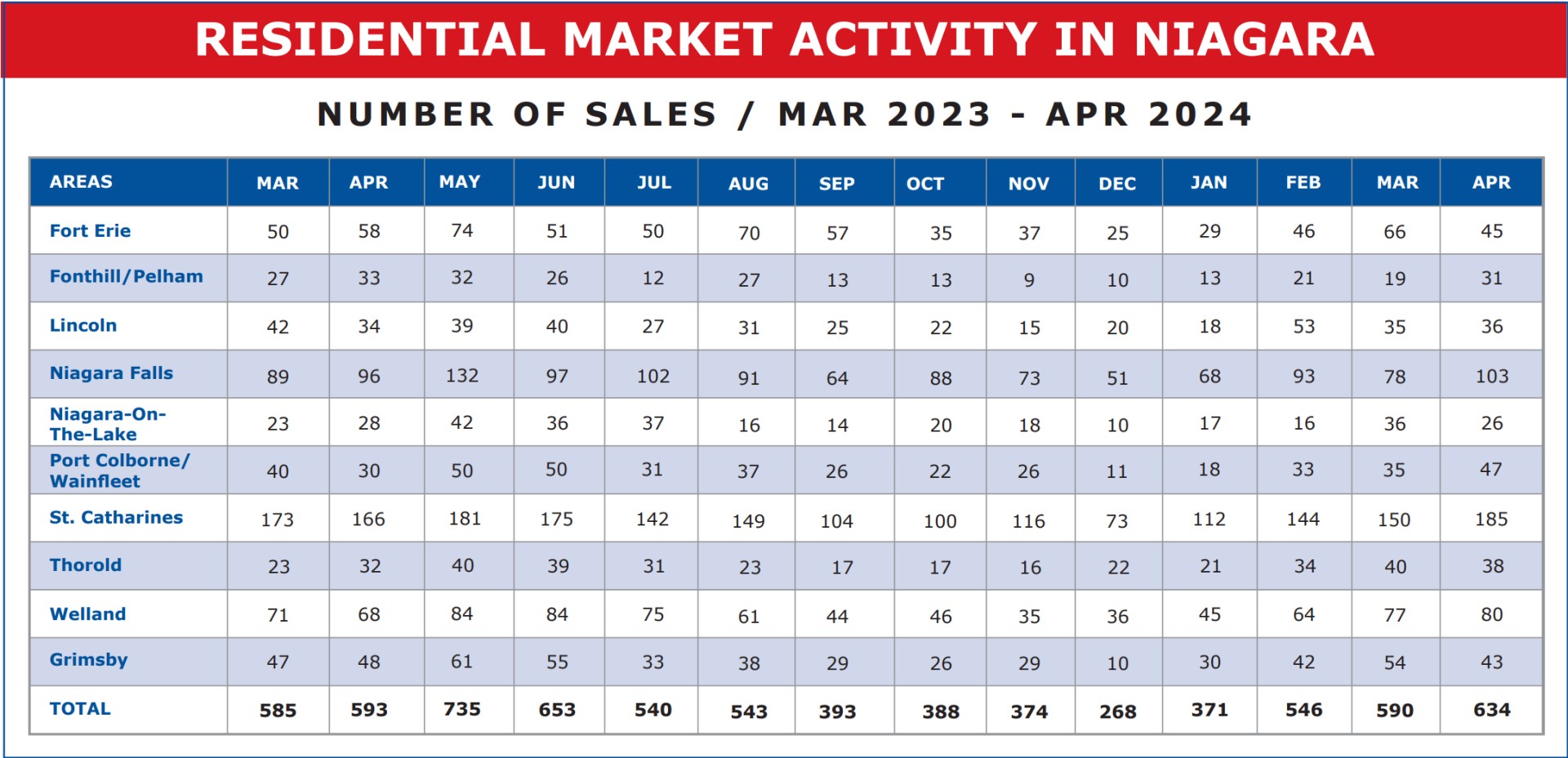

Another indicator that we like to follow and that is always informative is unit sales.

April 2024 registered 634 residential sales across the region. That’s up 44 units or 7.46% from March. And it’s also up 41 units or 6.9% from last April. In fact, the first four months of 2024 saw a total of 2,141 residential properties change hands in Niagara. Up 9.74% from the 1,951 that sold in the first 4 months of 2023. Again, not startling, but definitely trending in the right direction.

From a Realtor’s perspective I’d say we have a pretty sound market right now. Prices are relatively stable and inching upward and activity is increasing not only due to the spring market, but also on a year over year basis. People are out shopping and properly priced houses are definitely selling. But a spirit of uncertainty still abounds. The overall feeling is that once interest rates drop a measurable amount, the floodgates will open. And I believe that sentiment is correct but I maintain for the buyer, as interest rates drop, not only activity but also prices will increase. And that’s why investors are starting to get back in the game now.

It's not a question of if prices are once again going to skyrocket. The real question is when. Will it be a gradual climb back to a frenzied market, or will a specific change such as an interest rate drop open the floodgates? As I’ve said before – 2024 should prove to be a very interesting year in real estate.