May 15th 2025

Whenever we sit down to review the numerical sales data, month by month and year by year, we always look to see if there are any trends evident. I speak here both in terms of number of unit sales and also average residential sale price. And then we ask ourselves the question – “Why did this happen?”. What we are trying to do, of course, is extrapolate out and thus predict what will happen in the months ahead. We primarily follow unit sales and average residential sales prices. As I’ve said before, I don’t particularly track new listings coming in, because these numbers are unreliable. They include properties that expire and are re-listed as well as listings that are re-serviced. So, while available inventory is a useful barometer, new listings are not.

So, April figures are now in. What do we see? Well, both in unit sales and in average price we see a steady increase from January through April and presumably on into end of June. It’s the spring market.

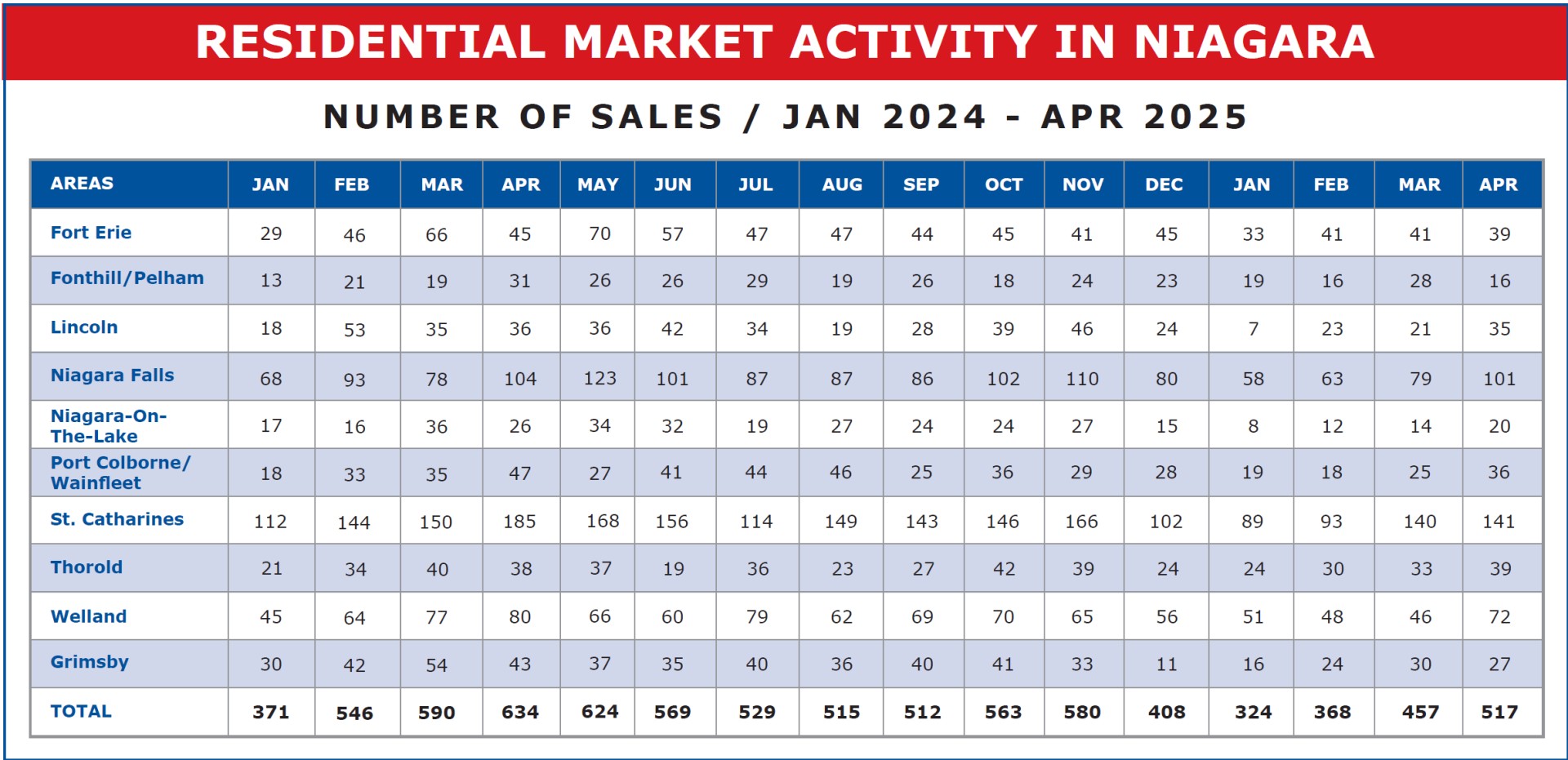

Let’s begin with unit sales. We began the year with 324 units sold in January, 368 in February, 457 in March and now 517 in April. Each month outperforming the previous. That’s pretty normal for an emerging spring market.

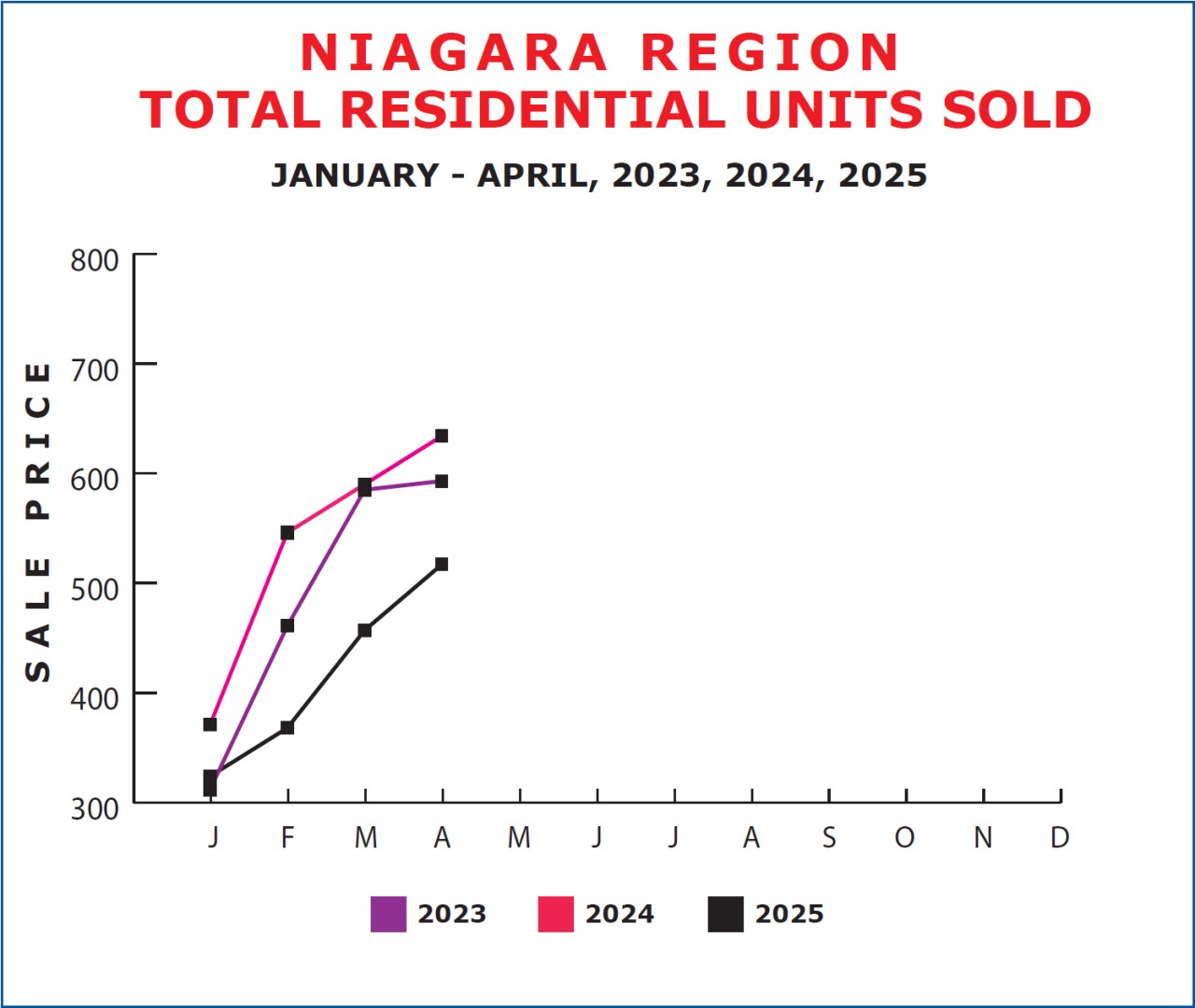

In fact, if you were to chart the activity you would see the same pattern emerging over the last 3 years.

Same pattern, but strangely enough, this year is softer than last, both in terms of price and especially in unit sales. As we have seen, April came in at 517 units sold. That’s up 193 units or 59.6% from January. Looking at last year, however, April 2024 came in at 634 units sold, so compared to last April we are down a total of 117 units or 22.6%. And as we can see by the chart above, in 2024 the first four months came in at 371, 546, 590 and 634 respectively. Same trend but each month the unit sales this year are softer than the corresponding month last year. And if we check back further, we see this same trend emerged in 2023 with January recording 312, February 461, March 585 and April 593.

We talked earlier about trends. On a graph, the upward trend manifests itself in each of the past three years, and in most normal years as well. But when we total up those first four months, we get a clearer picture of what is happening. January-April 2023 – 1,951 units sold, January-April 2024 – 2,141 units sold, but January-April 2025 only 1,666 units sold. Year over year, we are down 475 units or 22.2%. So why is activity down in 2025 after an upward trend the previous year? That is the $64,000 question.

But, now for a minute let’s switch our attention to average prices across the Region and we’ll see a similar trend. April 2025 average price came in at $697,902 that compares favourably to January, February and March which saw monthly averages of $645,689, $659,934 and $672,221 respectively. Each month gaining on the previous one and April showing a gain from January of $51,213 or 7.92%.

Looking back to 2024, same overall trend, with a slight reversal in March and April, but January began at $650,178 and by April had grown to $695,631. Here again a gain of $45,453 or 7.0%. 2023 same thing. January $627,561, February $622,773, March $694,280 and April $718,531. January to April a gain of $90,970 or 14.5%.

So, if we discount the 2020-2022 years which were greatly impacted by Covid, we see a consistent trend of price increases over the first 6 months of the year. The first 6 months of 2023 the average sale price across the region grew by $108,930. Then in 2024 this trend has repeated with the first 6 months gaining $93,932. So far this year, in the first 4 months we’ve seen prices rise by $51,213. And I’m sure there’s more to come.

But it’s really the second half of the year that tells the story. In both 2023 and 2024, most, if not all, the gains of the first 6 months were lost in the last half of the year. To the point that April 2025 while being up $2,271 from one year ago, is actually down $20,629 from April 2023.

So, stepping back and looking at the big picture, what are we seeing? A market that was picking up steam in 2024, only to slow down by about 25% so far in 2025, at least when it comes to unit sales. And prices that while experiencing substantial gains for the first half of the year, have really not gained any headway over the past couple of years.

And, while we can blame the election and the tariff threat on the one hand, they were balanced out by substantial cuts in interest rates over the past few months. No, what we are seeing is pretty much what we saw happen after the downturns of 1980 and 1990. The market wallowed around for a while with a ‘dead cat bounce’ in the recovery stages, but overall, a gradual improvement which took 4-5 years to recover. And then a very strong market emerged.

I see this market recession beginning in April 2022. So, we’ve completed 3 years and are now into the fourth. I think we’ll see prices continue to climb till mid-year, then crest. And I think momentum is going to begin to increase now. But it’s like a giant locomotive. Takes time and energy to get rolling. But as it speeds up, the acceleration increases and increases, until it becomes unstoppable. We saw it happen post 1980 and again post 1990. History will definitely repeat itself. Just how quickly we arrive at full recovery is still up in the air. A lot of factors come into play. Not the least of which is cuts to interest rates. But one thing is certain. Recovery is on its way.