November 15th 2023

The sales figures are in for the month of October and they really don’t contain a lot of surprises. In fact, the average sale price across the Region is almost exactly what it was last month, $673,383 in October compared to $673,674 in September. A drop of $288 or 0.04%. Negligible!

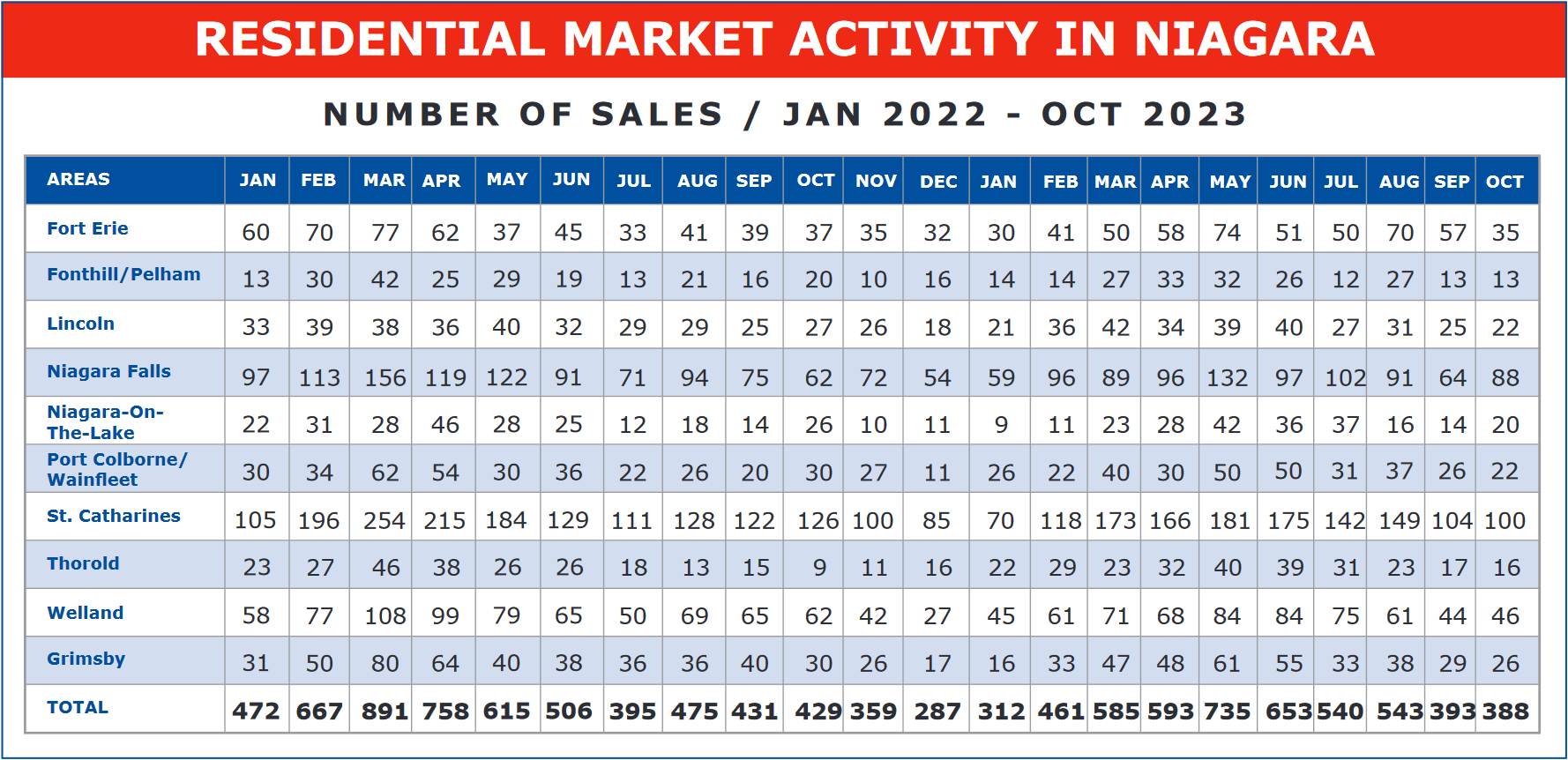

And that pretty much tells us where the market is these days. It’s relatively stable. But there is one other issue that comes to light as we look carefully at these figures, and that’s the lack of consistency from one municipality to the next. St. Catharines is the largest municipality, Niagara Falls is next, and Niagara-on-the-Lake comes in as the priciest. All three are up. Substantially. St. Catharines is up $35,409 or 5.41%. Niagara Falls is up $50,652 or 8.53% and Niagara-on-the-Lake is up $222,321 or 23.13%. But at the same time, other areas are down significantly. Thorold, for example, is down on average $130,257, Grimsby down $158,718, Fonthill/Pelham down $147,854. And on it goes.

What this is saying is that while the Region as a whole is registering consistency in overall sales prices and value, there is a lot of volatility in the market, driven by deteriorating home affordability due to interest hikes, buyer uncertainty, and individual motivation. And all that makes it extremely difficult for sellers and realtors alike when it comes to pricing properties for sale. In absolute terms, you can feel pretty confident. When you purchase now, the price is pretty secure. But, at the same time, are there situations where a motivated seller throws in the towel, while at the same time, two buyers compete to drive a price up beyond expectations? You bet.

And the other thing to keep in mind is volume of sales. As we move into the Christmas season and year-end, activity decreases. That’s just a seasonal reality. Last month you may remember we saw a very substantial drop in unit sales from the month previous (393 down from 543, a drop of 150 or 27.6%).

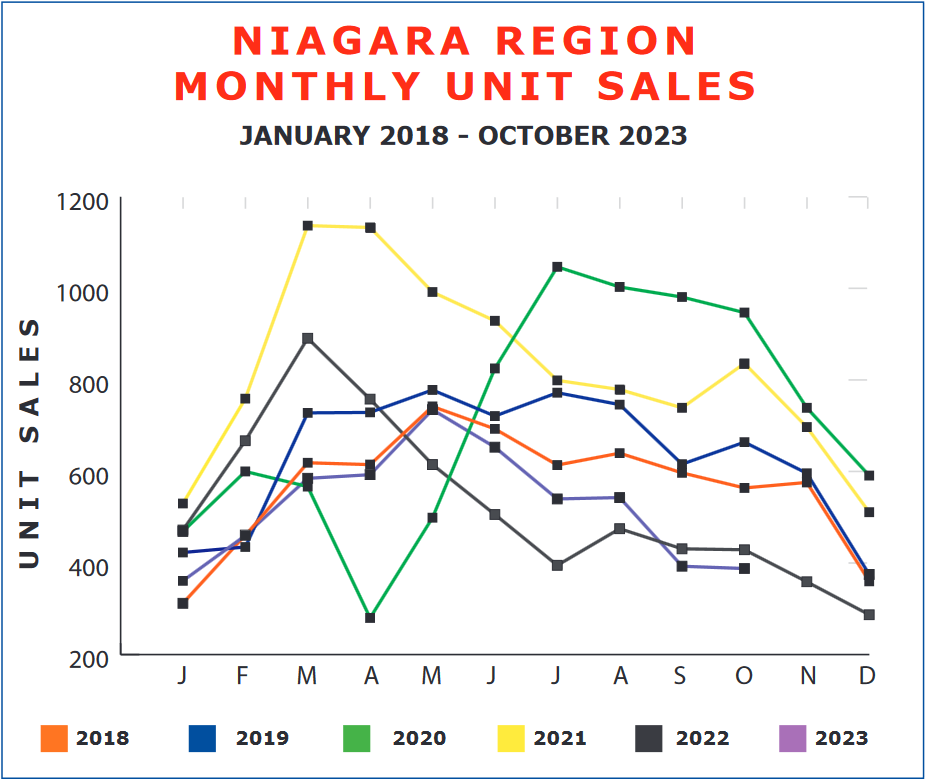

October came in pretty much the same as September with only a 5-unit drop in sales activity. This is pretty much what we saw last year. While 2021, which was an unusual year and market, the unit sales spiked in October. But as you can see from the accompanying graph, the number of sales is not only down due to the time of the year. It’s actually down from what we are used to seeing normally even in the pre-covid era.

This to me reinforces the fact that with all the forces at work, people are confused. And when people are confused, they procrastinate.

I say all that because people often ask me, ‘Where do you think the market is going in the future?’ and ‘How long before we get back to normal?’ With so many forces at play, it’s really hard to answer. What I can say with certainty, having been through a couple of significant downturns in the market over the years, the market will recover and will come roaring back. At some point in the not-too-distant future, we’ll look back and realize 2023 prices were really, really good. I mean, look at the average price back in 1980 and 1990. And look at the average price now.

I think the climate is excellent right now for buyers who are end users or investors. Prices have leveled. Inventory has increased nicely, and interest rates while being higher than we’ve seen in a while, are not high by historical standards, and I believe will moderate over the course of 2024. In the meantime, opt for short-term fixed or variable. Lock in when they are back down, and take advantage of an excellent opportunity to be in the market.