October 17th 2022

Things are quite unstable at the moment. And that isn’t just here in Ontario or Canada. The whole world is experiencing economic uncertainty. Many currencies around the globe are in free fall. And while here in Canada our dollar has taken a bit of a beating compared to the US greenback, we are faring extremely well against the British pound, the euro, and the Japanese yen.

But currency valuations are only a part of the story. There is also pretty universally high inflation around the globe, brought on in part by COVID-19 and the relative scarcity of goods that accompanied it, as well as the war in Ukraine and the fallout it has had on energy prices.

And whenever people face uncertain times, people’s natural reaction is to hesitate and wait the storm out. I’m convinced that’s what has been happening to the real estate market over the past several months. But I am a huge believer in real estate. It is the commodity of security and strength regardless of the economic climate.

I was on a cruise a couple of years ago, just pre-COVID. And one of the stops we made was in Columbia. We stopped at a quaint little village, and as I was wandering around, I ran into a young man selling currency. De-valued pesos. He had a collection of 10, 20, 50, 100, 1,000, 10,000 peso notes, all old currency and all virtually worthless.

One of the doctors on the ship was from Columbia. She told me about the run-away inflation the country was experiencing. She said she was extremely fortunate that she had bought a house. While inflation soared, so did the value of her home.

The peso dropped drastically against the US dollar but her house kept pace. She said, “Thank God my money was in real estate and not in the bank.”

Real stability for Niagara’s housing market needs two things to happen. We need to see an end to increased interest rates. Of course, we understand what the Bank of Canada is doing. They are trying to rein in inflation. And while interest rates are still exceptionally low compared to historic norms, they are still a lot higher than we have been used to in the last few years. And the other thing we need to see is a leveling off of prices.

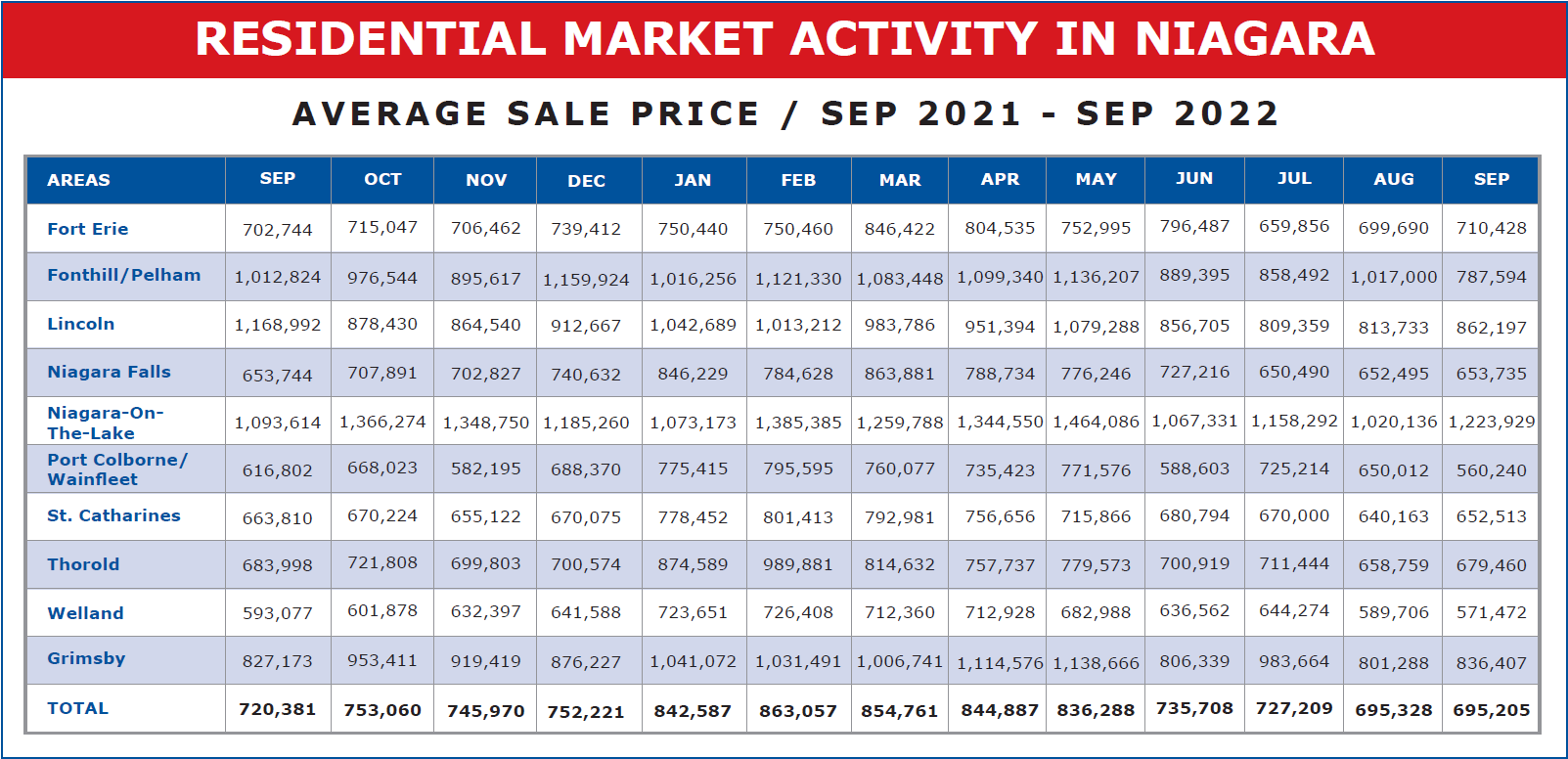

Well, the average sale prices for municipalities across Niagara are in for September and the average for September came in at $695,205. Almost identical to the $695,328 registered last month.

And while one month does not indicate a trend necessarily, it is a good sign. Not a universal trend, however. Of the 10 marketplaces in Niagara we report on, 7 are up over the last month. 3 are down.

And looking at the broader picture. Compared to the peak of the market in February of this year, when the average sale price was $863,057, we are down $167,852 or 19.45%. At the same time, we are up $219,247 or 46.06% from the $475,958 we registered in January 2020, just before COVID hit. So, a bit of a roller coaster ride, but overall in 2 ½ years, we haven’t fared too badly.

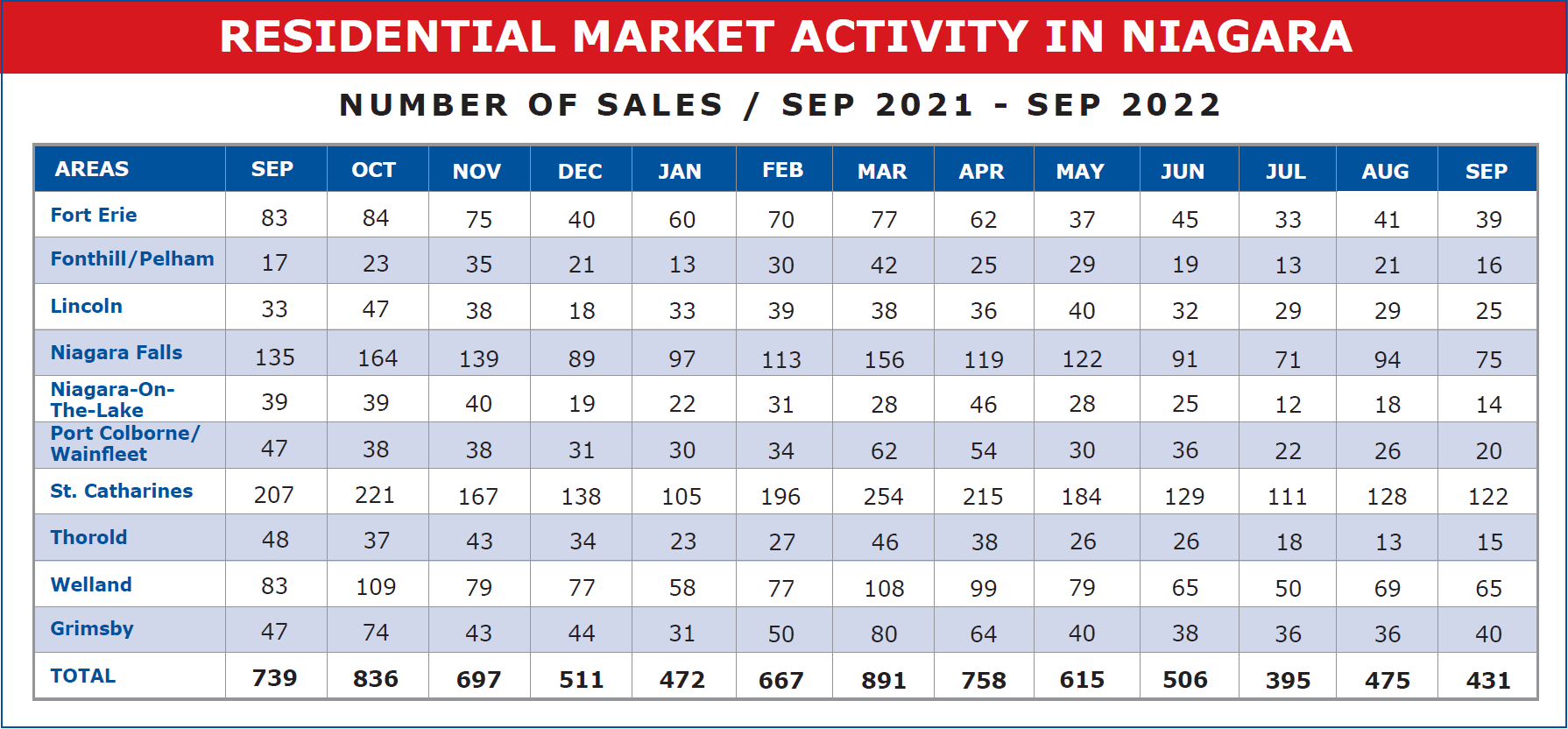

The other issue we need to look at is the number of unit sales. As we’ve stated, in uncertain times people procrastinate. And yet in September, we registered 431 residential units sold across Niagara. That’s down a bit from August, but up from July.

It lets me know that there remains a demand for real estate. In spite of unsettled times and economic uncertainty, people are still buying and selling homes and investment properties. And as things begin to stabilize, those numbers will increase. The speculators are for the most part sidelined, but they too will come back once prices begin to rise. And they will. You can bank on that. We’ve been here before.