October 16th 2023

Last month when the sales figures came in for August, we were surprised to see a significant downward trend in prices across almost every sector of the region. In some cases, the drop in average sale price was huge. Niagara Falls is down 9.80% for example, Fort Erie is down 8.56%, Welland is down 8.44%, and so on. In just one month. However, upon further investigation, we saw that the actual apples-to-apples price drop was only around one percent. We saw that when we consulted the H.P.I. which compares the selling prices of similar properties rather than the sales averages of all properties sold.

This month’s report, for September, is somewhat similar but much less extreme.

Overall, across the region, the average price for September came in at $673,674, down by $6,676 or 0.98% from August. A very marginal decline.

What is happening, though, is that buyers are spending less on the houses they are buying, and they are doing this by buying less house, not necessarily paying less than they would have a month ago. And in some ways that has been the story of 2023. Regionally we ended the year 2022 with an average sale price of $656,337. Prices at the end of September are still up from year-end by $17,337 or 2.64%. But they were up almost 10% until increased interest rates reduced consumers buying power.

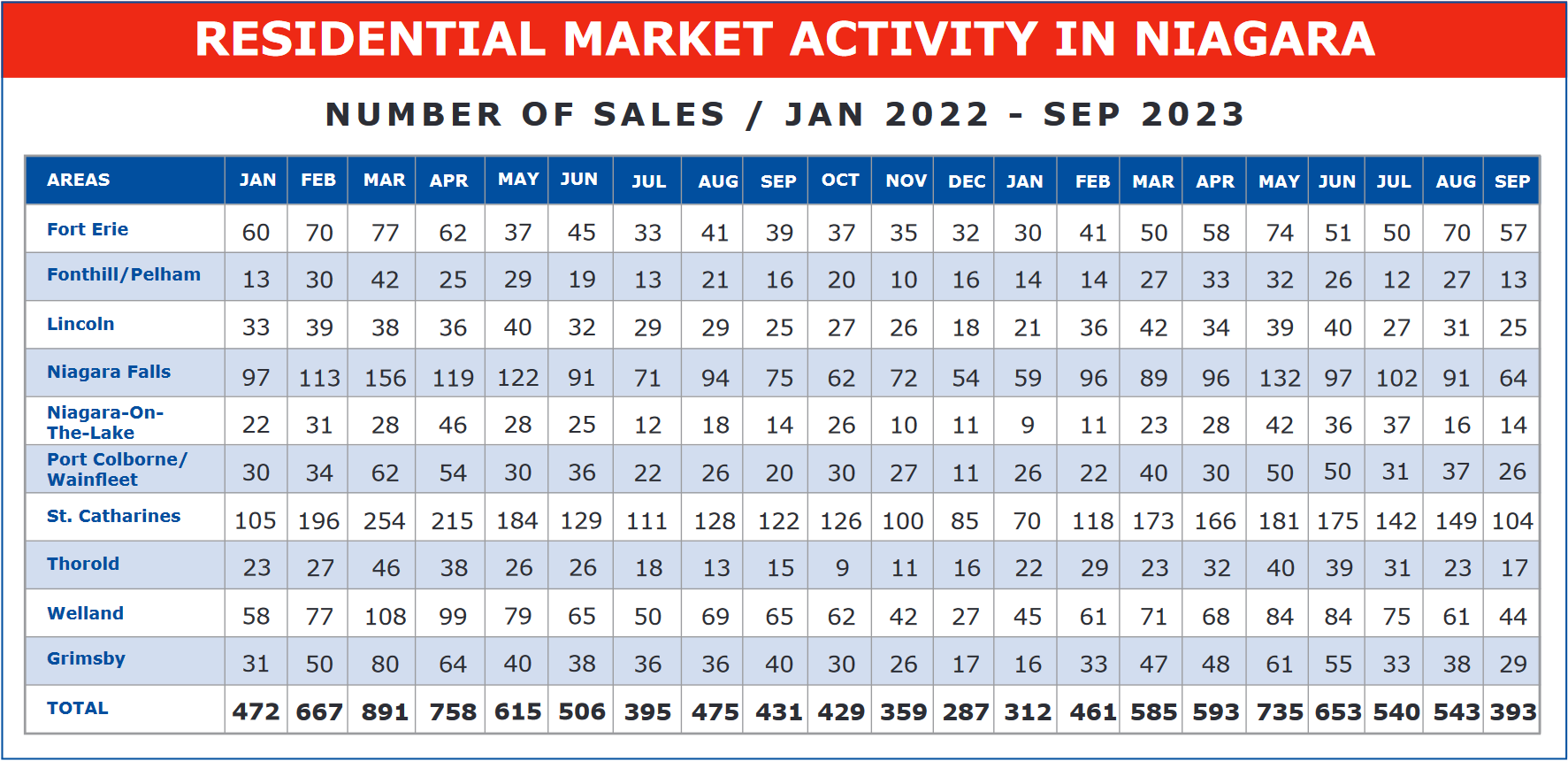

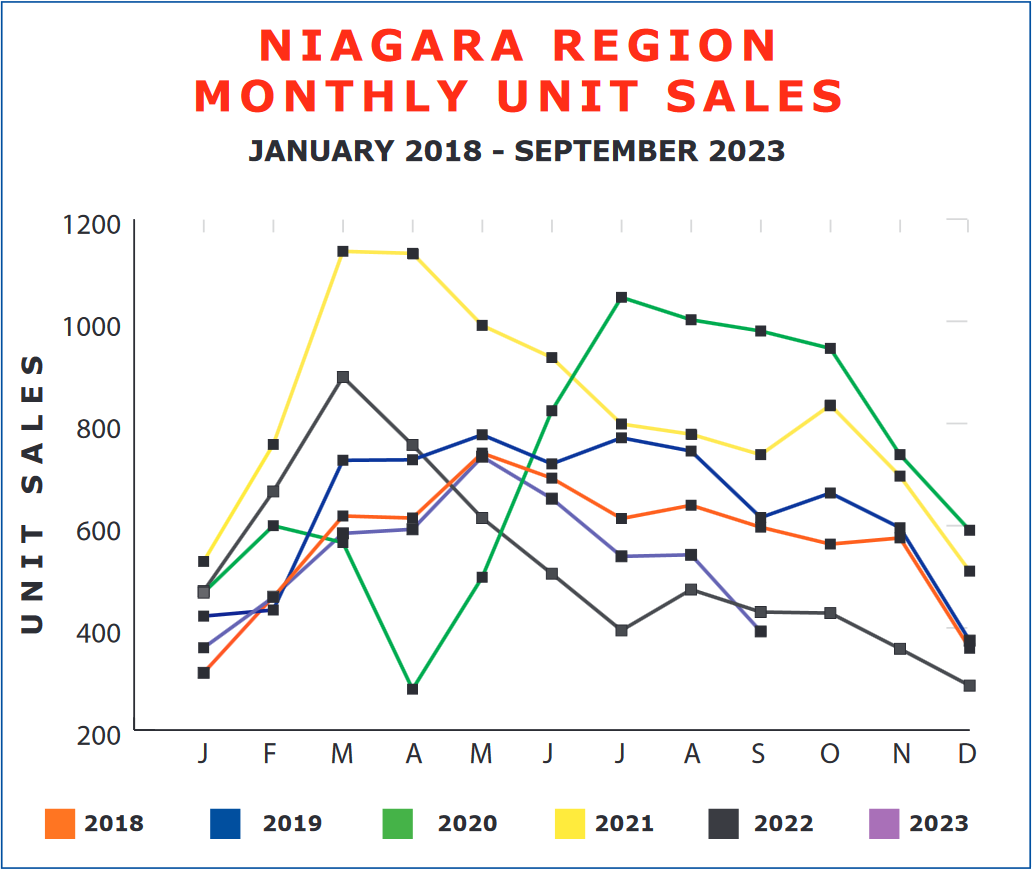

While prices have pretty much stabilized over the past year, one thing that has not is unit sales. And that is troubling. Normally from July on, the number of sales recorded each month decreases from the previous month. That is just a seasonal reaction and will continue until the end of the year.

But the number of sales recorded in September reflects a much more significant drop than we would normally expect. September recorded a total of only 393 residential units sold across the Region, down 150 units or 27.62% from the previous month and down 38 units or 8.82% from September 2022 when the market was in free fall. Have a look at that trend as shown on a graph and you’ll get an idea of how significant a drop this figure represents both in month-over-month change and also as compared to other years.

What is most concerning about this drop, is that while interest rate increases can have a downward effect on what properties people buy, decreased unit sales, if sustained can actually cause a downward shift in prices. Especially at a time when listing inventory is on the rise.

Let’s suppose for example that Mrs. McGillicutty needs to sell her house. But two or three very similar houses on her street are listed for sale and are not selling. What does she do? She lowers her price to make her house more saleable than the competitors. And to make matters worse one of her neighbours may react and do the same thing.

Only time will tell whether the decrease in market activity, beyond seasonal adjustments, is a trend or not and whether the result will be a slide in prices. We do know that activity will naturally decline as we move into the winter months and should pick up again in the spring. We know too that over time the market will come roaring back. How long that takes depends on a lot of factors, none the least of which is what the Feds decide to do with interest rates. Stay tuned.