June 15th 2019

Prices for residential property in and around Niagara have risen dramatically over the past 5 years. Almost doubled in fact. And of course, this applies as well for residential rental properties. It only stands to reason that if the acquisitions costs of rental property is about 80% higher than it was 4 or 5 years ago, correspondingly rent must rise accordingly. And it has. The cost of renting anything in the area, be it a 2 bedroom apartment, a semi or a detached home is substantially higher than it was just a few short years ago. But not in every case. The reason? – Rent Controls!

Prices for residential property in and around Niagara have risen dramatically over the past 5 years. Almost doubled in fact. And of course, this applies as well for residential rental properties. It only stands to reason that if the acquisitions costs of rental property is about 80% higher than it was 4 or 5 years ago, correspondingly rent must rise accordingly. And it has. The cost of renting anything in the area, be it a 2 bedroom apartment, a semi or a detached home is substantially higher than it was just a few short years ago. But not in every case. The reason? – Rent Controls!

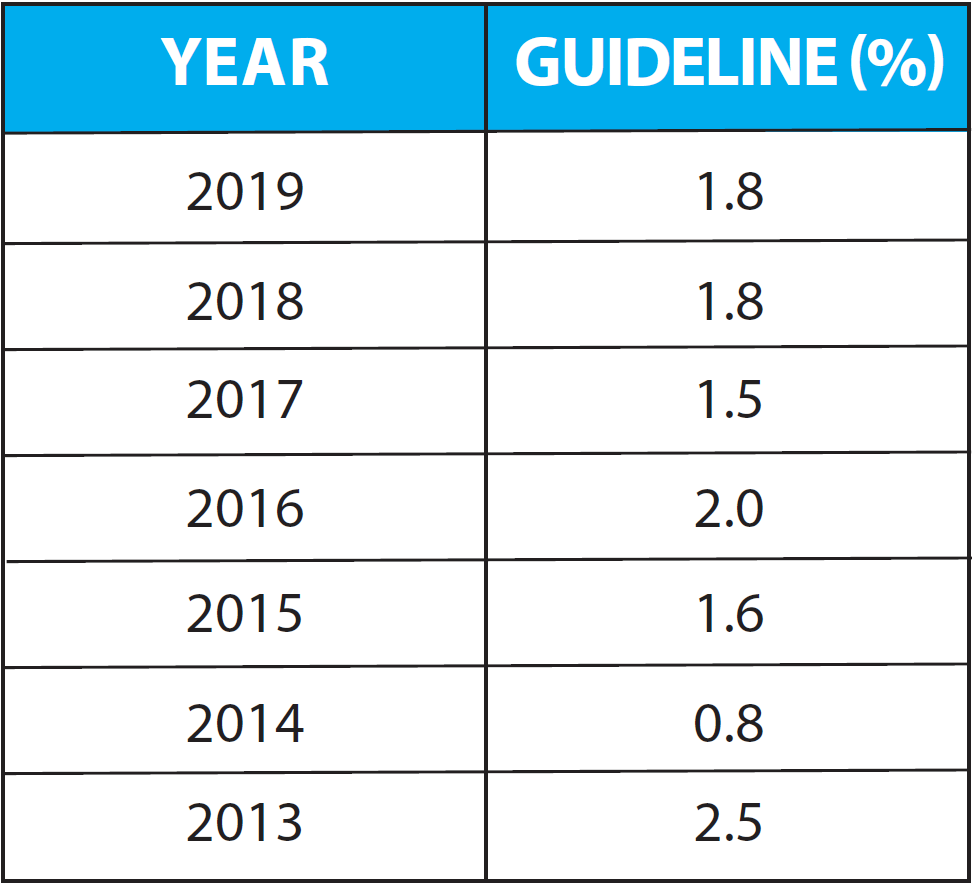

Under the previous Consumer Protection legislation known as ‘The Tenant Protection Act’ Rent Controls were fully in place in Ontario. Once a rental rate was established on a residential rental, it was locked in. The landlord could raise the rent only according to Government guidelines set annually. If he/she neglected to do so, that potential rent increase was lost forever.

Under the current legislation, ‘The Residential Tenancies Act’, Rent Controls are still in place but the rules have loosened somewhat. Landlords are still restricted to a Government dictated maximum annual rent increase, this year 2019, set at 1.8%. But now if the unit becomes vacant, the landlord is free to set the rent to market rent, or whatever he wishes to charge.

Under the current legislation, ‘The Residential Tenancies Act’, Rent Controls are still in place but the rules have loosened somewhat. Landlords are still restricted to a Government dictated maximum annual rent increase, this year 2019, set at 1.8%. But now if the unit becomes vacant, the landlord is free to set the rent to market rent, or whatever he wishes to charge.

Because of this loosening of control, what many landlords do is rather than adjust their rents on an annual basis, they wait until a tenant vacates and then adjust their rent at that point. And they have some good reasons for doing so.

For one thing, tenant turnover is expensive. Usually when a tenant vacates, there are expenses involved in getting the unit ready to rent. Carpets may have to be cleaned or replaced. Walls may need to be painted. Then there is the hassle of showing the unit and possible down time and loss of revenue when the unit is vacant a month or two between tenants. So, when they have a good tenant in place, rather than potentially rocking the boat with a rent increase, they just leave things be.

The problem is that some tenants never move!

This is one mistake I’ve made. I generally keep my rents below market rent, but in some cases I’ve got tenants that have been with me 18-20 years and I’m embarrassed to say that in those cases the rent I am charging is about half current market rent. Now, I’m going to begin making annual rent increases as per the guidelines, but with this process I can never catch up. All I can do is keep from sliding further behind. The only real remedy for those situations is adjustment when the tenants move, if and when that ever happens.

This is one mistake I’ve made. I generally keep my rents below market rent, but in some cases I’ve got tenants that have been with me 18-20 years and I’m embarrassed to say that in those cases the rent I am charging is about half current market rent. Now, I’m going to begin making annual rent increases as per the guidelines, but with this process I can never catch up. All I can do is keep from sliding further behind. The only real remedy for those situations is adjustment when the tenants move, if and when that ever happens.

Now, what I am asked often by agents and buyers alike is “A new buyer is buying the property at today’s prices. The rents are chronically low. How can I get vacant possession so I can increase the rents to market levels?” The simple answer is, you can’t. There is provisions for evicting a tenant because an immediate family member needs the unit. But this should be used because a family member does need the unit, not just to gain vacant possession in order to raise the rent.

In fact, the evicted tenant can come back and challenge the eviction up to 12 months from the time of the eviction if he believes he was misled. I should mention there are provisions under the legislation to apply to the Landlord Tenant Board for a rent increase based on excessive municipal taxes, unusual capital  expenditures or increased security costs. But again these heightened increases only counterbalance increased costs. They don’t help you gain lost ground.

expenditures or increased security costs. But again these heightened increases only counterbalance increased costs. They don’t help you gain lost ground.

There is another reason you should consider annual increases on your rental units. Most landlords, at the time they rent a unit collect and hold last month’s rent on deposit. The legislation requires the landlord to pay interest on that rent deposit. The interest rate changes every year. It is set to match the maximum annual rent increase guidelines.

What that means is that if applied annually, the last month rent held on deposit would grow exactly as does the rent. When the tenant does eventually leave the unit, rather than calculating and paying interest, the landlord would simply apply the tendered last month rent against the last month. It would have grown accordingly.

If you will be giving your tenant annual rent increases, the form you use is an N1. It must be given at least 90 days before the new rent takes effect and can only come into effect 12 months after the tenant moved in or at least 12 months since the tenant’s last increase. To download the forms go to www.sjto.ca/ltb and click on forms.

Wayne Quirk, Author

“THE MONEY MACHINE”

wayneq@remax-gc.com